When you withdraw from your IRA in Indiana, you will be subjected to a flat rate of 3.15% for state income tax. This implies that every dollar withdrawn will be added to your adjusted gross income, potentially increasing your total tax liability. Unfortunately, there are no exemptions for these withdrawals, making effective financial planning crucial. It is important to note that while Social Security benefits are not taxed, other retirement incomes such as pensions are taxed at the same rate. Recognizing these consequences can assist you in better strategizing your withdrawals. Stay tuned to learn more about effectively managing your retirement finances.

Key Takeaways

- IRA withdrawals in Indiana are fully taxable at a flat income tax rate of 3.15%, impacting overall tax liability.

- There are no specific deductions or exemptions for IRA withdrawals, making tax planning essential for retirees.

- Social Security benefits are exempt from Indiana state income tax, providing a tax-free income source.

- Seniors aged 65 and older receive a $1,000 income tax exemption, reducing their taxable income.

- Understanding local income taxes is crucial, as they may increase the overall tax burden on IRA withdrawals.

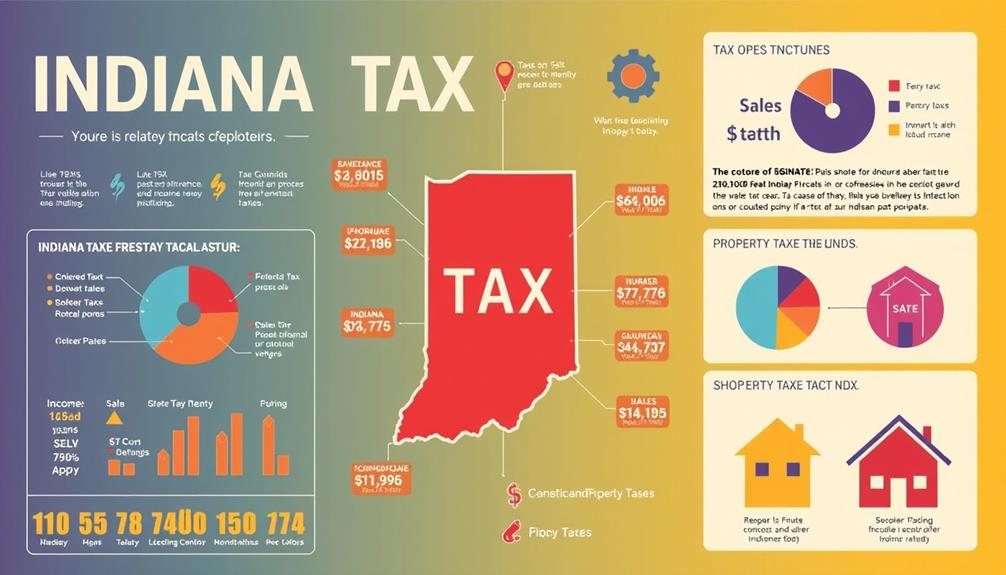

Indiana's Tax Structure Overview

Indiana's tax structure offers a straightforward approach that can be beneficial for retirees. With a flat income tax rate of 3.15% for 2023, which will decrease to 3.05% in 2024, you'll find it easier to manage your finances. Remarkably, Indiana taxes don't apply to Social Security benefits, giving you some tax relief if you're relying on this income during retirement.

Additionally, many retirees consider diversifying their portfolios with precious metals, which can be advantageous in a Gold IRA for long-term savings and stability Gold IRA options.

However, it's important to note that while pension income and distributions from retirement plans like 401(k)s and IRAs are taxable, they fall under the same flat income tax rate. Your adjusted gross income (AGI) will include these amounts, affecting your overall tax liability.

Additionally, local income taxes may apply in certain jurisdictions, potentially increasing your overall tax burden.

Homeowners will appreciate Indiana's average property tax rate of 0.84%, which is lower than the national average. This can be a significant advantage as you plan your retirement budget.

While most retirement income is taxable, the state's straightforward tax structure provides clarity, allowing you to better anticipate your financial responsibilities as you shift into retirement.

IRA Withdrawals and State Tax

When planning for retirement in Indiana, it's important to contemplate how IRA withdrawals will impact your overall tax situation. Understanding common financial terms like credit score can also help you navigate the complexities of retirement planning.

Unlike Social Security benefits, which are exempt from state tax, all IRA distributions are fully taxable at Indiana's state income tax rate of 3.15%, set to decrease to 3.05% in 2024. This flat rate applies to the entire amount you withdraw, notably affecting your adjusted gross income.

Since Indiana doesn't offer specific deductions or exemptions for IRA withdrawals, you'll need to account for these taxable amounts in your financial planning. It's essential to understand that every dollar you take from your IRA adds to your tax burden, influencing your retirement planning strategies.

By considering the tax implications now, you can better budget your income and manage your finances in retirement. Incorporating these factors into your overall strategy helps guarantee that you're prepared for the financial realities of retirement.

Tax Benefits for Seniors

As a senior in Indiana, you can take advantage of several tax benefits that can ease your financial burden.

Understanding how to leverage these benefits, such as property tax exemptions and income tax deductions, can greatly impact your retirement planning.

Additionally, considering strategies like a Gold IRA Rollover can provide further financial security.

Understanding these benefits is essential as you navigate the regulations around your retirement accounts.

Property Tax Exemptions

For seniors aged 65 and older, property tax exemptions can offer considerable financial relief in Indiana. These exemptions can reduce the assessed value of your home by up to $14,000, which in turn lowers your property tax liability.

If you're a senior with a combined adjusted gross income of $40,000 or less, you might qualify for these property tax breaks. Additionally, Indiana provides an extra circuit breaker credit, capping property tax increases at 2% of your home's assessed value, making it easier to manage your expenses.

With Indiana's median property tax rate at just 0.84%, which is lower than the national average of 1.01%, you'll find further tax relief as a homeowner.

Furthermore, Indiana doesn't impose estate or inheritance taxes, simplifying your estate planning and financial management. This means you can focus more on enjoying your retirement rather than worrying about tax burdens.

Income Tax Deductions

Understanding Indiana's income tax deductions can greatly benefit seniors, especially those managing retirement finances. By taking advantage of these deductions, you can considerably reduce your taxable income and improve your overall financial situation. Here are three key aspects to reflect on:

- Income Tax Exemption: Seniors aged 65 and older can claim an exemption of $1,000, decreasing your taxable income and lowering your overall state income tax burden.

- Property Tax Deduction: Indiana offers a property tax deduction for seniors, which can provide a reduction of up to $14,000 in assessed value, resulting in substantial savings on property taxes.

- Social Security Benefits: Remember, while your Social Security benefits are exempt from state income tax, IRA withdrawals and distributions from 401(k)s are not. They'll be taxed at Indiana's flat income tax rate of 3.15%, which is set to decrease to 2.9% by 2027.

Being aware of these Indiana tax deductions and exemptions for seniors is essential for effective retirement planning.

Savvy financial management can help you navigate the implications of IRA withdrawals and optimize your retirement years.

Retirement Account Regulations

Maneuvering the regulations surrounding retirement accounts can substantially impact your financial well-being in retirement. In Indiana, understanding how your retirement income is taxed is essential for effective financial planning. For instance, distributions from IRAs and 401(k)s are subject to a flat income tax rate of 3.15%, which will decrease to 3.05% in 2024. However, Social Security benefits remain exempt from state income tax, providing a tax advantage for retirees relying solely on these benefits.

Here's a quick overview of how different sources of retirement income are taxed in Indiana:

| Retirement Income Source | Tax Status |

|---|---|

| IRA Withdrawals | Taxed at flat income tax rate |

| 401(k) Distributions | Taxed at flat income tax rate |

| Pension Income | Taxed at flat income tax rate |

| Social Security Benefits | Exempt from state income tax |

| Property Tax Reductions | Available for residents 65+ |

Keep in mind that Indiana has no estate or inheritance tax, simplifying your financial planning. Additionally, if you're aged 65 or older, you may qualify for property tax reductions, further enhancing your financial situation.

Social Security Tax Exemptions

Social Security benefits provide a significant financial cushion for retirees, especially in states like Indiana where these benefits are completely exempt from state income tax.

This tax exemption allows you to focus on your retirement income without worrying about additional state tax liabilities.

Here are three key benefits of this exemption:

- Complete Exemption: All Social Security income is free from state income tax, making it a reliable source of funds.

- Tax Advantages: You can subtract federal taxable Social Security income from your state returns, increasing your tax benefits.

- Offset Other Taxes: The lack of state tax on Social Security helps compensate for taxes on other retirement incomes, like pensions and IRA withdrawals, which are subject to Indiana's flat income tax rate of 3.15%.

Other Retirement Income Taxation

When you're planning for retirement in Indiana, it's important to understand how your pension, 401(k), and IRA withdrawals will be taxed.

Unlike Social Security benefits, which are exempt from state taxes, these income sources are subject to a flat rate of 3.15%.

Knowing this can help you better prepare for your overall tax burden and financial strategy.

Pension Taxation Overview

Understanding the tax landscape for pension income is essential for effective retirement planning in Indiana. Here are three key points to take into account:

- State Income Tax Rate: Pension income in Indiana is taxed at a flat rate of 3.15%, and this rate will decrease to 3.05% in 2024.

- Taxable Distributions: Unlike Social Security benefits, which are exempt from state taxation, pension distributions from employer-sponsored plans and private annuities are fully taxable as regular income.

- Retirement Account Withdrawals: All retirement account withdrawals, including IRA distributions, are also subject to the same flat state income tax rate of 3.15%.

These tax implications can greatly affect your financial planning strategies.

Remember, the taxation of your pension income and retirement account withdrawals means you need to account for these amounts when evaluating your overall retirement income.

Fortunately, Indiana doesn't impose estate taxes, simplifying financial planning for retirees with substantial pension income.

As you strategize for retirement, understanding these dynamics will help you maximize your benefits and minimize your tax burdens.

401(k) and IRA Taxation

The tax implications for IRA withdrawals in Indiana are significant and warrant your attention as you plan for retirement. In 2023, distributions from your IRA and 401(k) accounts are subject to Indiana State Tax at a flat rate of 3.15%. This means that your retirement income from these sources will directly impact your overall financial picture.

It's essential to understand how your IRA withdrawals interact with other retirement income, such as pensions. Additionally, Indiana doesn't tax Social Security benefits, which can be a substantial advantage for retirees relying solely on these funds.

By optimizing your financial planning strategies, you can minimize your state income tax liabilities. Consider the implications of withdrawing from your retirement savings accounts carefully, as the taxation on these funds can affect your long-term financial health.

Be proactive in understanding the tax treatment of your IRA withdrawals compared to other sources of retirement income. This knowledge will enable you to devise a more effective financial plan, ensuring you make the most of your hard-earned savings while maneuvering Indiana's tax landscape.

Planning for Retirement Taxes

Retirement tax planning is essential for maximizing your income and minimizing liabilities as you shift into this new phase of life.

In Indiana, understanding the tax implications of your IRA withdrawals can greatly influence your retirement income. Here are three key factors to take into account:

- State Income Tax: Unlike Social Security benefits, IRA withdrawals are fully taxable at Indiana's flat rate, currently 3.15% and set to decrease to 3.05% in 2024, and 2.9% by 2027.

- Property Tax: Indiana's median property tax rate of 0.82% can impact your overall financial situation, affecting your retirement planning.

- Financial Advisory: Engaging a financial advisor can help you strategize your IRA withdrawals, optimizing your retirement income while minimizing tax burdens.

Frequently Asked Questions

Do You Pay State Income Tax on IRA Withdrawals?

Yes, you pay state income tax on IRA withdrawals. Currently, Indiana imposes a flat rate of 3.15%, which is set to decrease in the coming years. Plan your withdrawals to manage your tax liability effectively.

Is Indiana a Reciprocal State?

No, Indiana isn't a reciprocal state. This means if you work in another state, you'll still owe taxes to Indiana on your total income, including what you earn outside the state.

What Is the State Income Tax in Indiana?

In Indiana, the state income tax rate is currently 3.15%. This rate is set to decrease to 3.05% in 2024 and further to 2.9% by 2027, benefiting your financial planning.

Do You Pay Taxes on IRA Withdrawals After 65?

So, you thought turning 65 meant a tax-free IRA party? Sorry, but even in your golden years, you'll still pay state income tax on those withdrawals. Retirement's not all sunshine and rainbows, is it?

Conclusion

As you navigate your retirement journey in Indiana, remember that understanding state tax implications for IRA withdrawals can save you money and stress down the line. Like a compass guiding you through uncharted waters, knowing the tax benefits available—especially for seniors—can help you chart a clearer course. By planning ahead, you can enjoy your golden years without worrying about unexpected tax bites. So, arm yourself with knowledge and sail smoothly into retirement!