Were you aware that the worldwide gold market is valued at more than $7 trillion, whereas the global real estate market is valued at over $280 trillion?

When it comes to investing, gold and real estate are two popular options that offer unique advantages and disadvantages. While gold provides liquidity and accessibility, real estate offers diversification and the potential for higher returns. Deciding between the two can be a daunting task, but understanding their differences and historical performance can help you make an informed decision.

Key Takeaways:

- Gold and real estate are valuable investment options with their own set of pros and cons.

- Gold provides liquidity and accessibility, making it an easy investment for new investors.

- Real estate offers diversification and the potential for higher returns based on property value appreciation and rental income.

- Consider factors such as historical performance, market demand, expected returns, and tax implications when choosing between gold and real estate investments.

- Consulting with a financial advisor can provide further guidance in making an informed investment decision.

Whether you’re a seasoned investor or just starting out, this article will delve into the main differences between gold and real estate as investments, analyzing their liquidity, diversification, tangibility, financing options, volatility, maintenance costs, tax implications, and historical performance. By the end, you’ll be equipped with the knowledge to determine which investment option is better suited to your financial goals and risk tolerance.

*Data as of 2020

Main Differences Between Gold and Real Estate as an Investment

When comparing gold investment and real estate, it is important to understand the main differences between these two assets. Gold and real estate offer distinct advantages and disadvantages, making them unique investment options. Let’s explore the key factors that differentiate gold and real estate investments.

Liquidity and Accessibility

Gold is known for its liquidity and accessibility, making it an attractive investment for many individuals. Gold can be easily purchased and sold through various channels, such as online dealers, pawn shops, or storefronts. This accessibility allows investors to enter and exit the market quickly, providing flexibility and liquidity to their investment portfolios.

In contrast, real estate investments involve a more complex buying and selling process that can take months to complete. The purchase of real estate requires engaging in negotiations, conducting inspections, and finalizing legal agreements. Due to these intricacies, real estate investments are generally less liquid and require a more long-term commitment.

Tangibility

One of the major differences between gold and real estate investments is tangibility. Gold is a physical asset that investors can possess and store. Many individuals appreciate the tangible nature of gold, as they can physically see and hold their investment.

Real estate also offers a high level of tangibility, but it can vary depending on the investment method. Buying a property outright provides investors with full control and visibility over their investment. However, investing in real estate through vehicles like real estate investment trusts (REITs) or real estate groups may limit the level of control and tangibility over a specific property.

Financing and Leverage

Gold investments generally require cash payment, as the purchase of gold typically involves directly buying the physical metal. There are alternatives such as gold-backed individual retirement accounts (IRAs), which allow investors to hold gold within a retirement account. However, the liquidity of gold can be affected by the structure of the investment vehicle.

Real estate investments, on the other hand, often involve the use of financing options. Investors can leverage their initial capital by obtaining mortgages to fund the purchase of properties. This ability to leverage investments can potentially amplify returns and provide opportunities for growing a real estate portfolio.

Comparison of Gold and Real Estate Investments

| Factors | Gold | Real Estate |

|---|---|---|

| Liquidity and Accessibility | Easily bought and sold | Less liquid; complex buying/selling process |

| Tangibility | Physical asset | Physical asset (varies with investment method) |

| Financing and Leverage | Cash payment; gold-backed IRAs | Use of mortgages; opportunity for leverage |

Understanding the main differences between gold and real estate investments is key to making an informed decision. While gold offers liquidity, tangibility, and simplicity, real estate provides opportunities for leverage and control over properties. The choice between these two options ultimately depends on individual investment goals, risk tolerance, and preferences.

Liquidity and Accessibility

When it comes to the accessibility of investments, gold and real estate differ significantly. Gold is known for its high liquidity, making it easy to buy and sell. Whether you prefer online dealers, pawn shops, or physical storefronts, there are numerous outlets available to facilitate gold transactions. Investors can quickly convert their gold holdings into cash, providing a level of flexibility and accessibility that is hard to match.

On the other hand, real estate investments require a more involved buying and selling process. The intricate nature of property transactions means that it can take months to finalize a real estate deal. Potential investors must navigate various stages, such as property searches, negotiations, inspections, and legal paperwork. This complexity can be a barrier to entry for individuals seeking a more streamlined and accessible investment option.

Furthermore, the accessibility of real estate is often limited by financial considerations. Purchasing a property typically requires a significant upfront investment in the form of a down payment. Without substantial savings or access to mortgage financing, many individuals find real estate investment to be financially out of reach.

By contrast, the accessibility of gold investment is not contingent on large upfront payments or mortgage qualifications. Investors can start small, purchasing gold in smaller denominations or even opting for gold-backed IRAs (Individual Retirement Accounts). This accessibility, coupled with the ease of liquidating gold, makes it an attractive investment choice for both new and experienced investors.

Gold Investment Accessibility

Gold investment offers:

- High liquidity

- Multiple buying and selling channels

- Flexible investment options, including gold-backed IRAs

Real Estate Investment Accessibility

Real estate investment requires:

- Complex buying and selling processes

- Significant upfront investment, including down payments

- Mortgage qualifications

Diversification and Risk Management

When it comes to investing, diversification and risk management are essential components of a successful portfolio strategy. Both gold and real estate offer unique opportunities for diversifying investments and managing risk. By incorporating these assets into a well-balanced portfolio, investors can potentially mitigate risks and enhance overall returns.

Diversification of Gold Investment

Gold has long been considered a safe haven and a hedge against market volatility. Its performance tends to be uncorrelated with traditional assets like stocks and bonds, making it an effective diversification tool. Adding gold to a portfolio that consists mainly of stocks and bonds can help reduce overall volatility and provide stability during uncertain times. The price of gold is driven by factors such as supply and demand, geopolitical events, and inflation, which can move independently of other asset classes.

Diversification of Real Estate Investment

Real estate investments offer a unique opportunity to diversify a portfolio and generate income through rental properties or property value appreciation. Real estate tends to have a low correlation with other asset classes, such as stocks and bonds, making it an effective diversification tool. By investing in different types of properties, locations, and real estate investment vehicles, such as real estate investment trusts (REITs), investors can further diversify their real estate holdings and spread their risk across multiple properties or regions.

“The diversification benefits of gold and real estate can help investors achieve a more balanced and resilient portfolio.”

Risk Management in Gold Investment

Gold is often considered a safe and reliable investment due to its long history of preserving value. However, like any other investment, gold carries its own set of risks. The price of gold can be influenced by various factors, such as economic conditions, interest rates, and geopolitical events. Therefore, it is crucial for investors to carefully monitor these factors and make informed decisions based on their risk tolerance and investment goals. Additionally, investors should ensure they are purchasing gold from reputable sources to avoid counterfeit or low-quality products.

Risk Management in Real Estate Investment

Investing in real estate comes with its own set of risks, such as economic downturns, changes in local housing markets, and tenant-related issues. Investors need to analyze market conditions, conduct due diligence on properties, and manage their properties efficiently to mitigate these risks. Proper risk management in real estate investment involves strategies such as thorough market research, diversifying property holdings, maintaining adequate insurance coverage, and having contingency plans for unexpected events.

By diversifying their portfolios with both gold and real estate, investors can allocate their investments across different asset classes, reducing the overall risk inherent in any one investment. Moreover, effectively managing the risks associated with gold and real estate can lead to better long-term outcomes and protect against significant market fluctuations.

Comparison of Diversification and Risk Management Potential

| Gold Investment | Real Estate Investment | |

|---|---|---|

| Diversification Potential | Effective diversification tool due to low correlation with traditional assets | Offers diversification opportunities through property types and locations |

| Risk Factors | Price influenced by economic conditions, inflation, and geopolitical events | Subject to market fluctuations, economic downturns, and tenant-related risks |

| Risk Management Strategies | Monitor economic indicators and purchase from reputable sources | Thorough market research, diversification, insurance coverage, and contingency plans |

Tangibility

When it comes to investing, tangibility plays a significant role in the decision-making process. The ability to physically possess an asset can provide a sense of security and control for many investors.

Investing in physical gold offers the unique advantage of tangibility. Holding a gold coin or bar in your hand can be a satisfying experience, giving you a physical connection to your investment. This tangible quality of gold is often cherished and appreciated by investors who prefer a more hands-on approach.

“Investing in gold provides me with a tangible asset that I can see and touch. It gives me peace of mind knowing that I have something of value in my possession,” says Sarah, an experienced investor.

Real estate also offers a high level of tangibility, although it can vary depending on the method of investment. Owning a physical property allows you to visually experience the value of your investment and make necessary improvements or upgrades to enhance its worth.

However, it’s essential to note that tangibility in real estate can differ depending on the investment approach. Investing in real estate investment trusts (REITs) or participating in real estate groups may provide less direct control over the property itself, but it still offers an opportunity to benefit from the tangible nature of real estate as an asset class.

Financing

When considering investments in gold or real estate, understanding the financing options available is crucial. Gold investments generally require cash payment, making it necessary to have the funds readily available. However, there are alternatives for investors who prefer to finance their gold purchases. One such option is a gold-backed Individual Retirement Account (IRA). This allows individuals to invest in gold while still enjoying the tax advantages and benefits of an IRA.

On the other hand, real estate investments typically involve a down payment and closing costs. The exact amounts vary depending on the property’s price and the lender’s requirements. Many investors choose to apply for mortgages to finance their real estate purchases. Mortgages allow buyers to spread the cost of the property over an extended period, making it more affordable and manageable.

In addition to mortgages, real estate investments open the door to various financing opportunities. One of these is leveraging one property to purchase additional properties. Investors can use second mortgages or home equity lines of credit (HELOCs) to tap into the equity of their existing property, enabling them to expand their real estate portfolio.

Whether you’re considering gold or real estate, understanding the financing options available will help you make informed investment decisions. Carefully evaluate your financial situation, risk tolerance, and investment goals to choose the financing method that aligns with your needs.

Volatility

When it comes to investment options, volatility is an important factor to consider. Volatility refers to the degree of fluctuation or price instability that an investment experiences over a given period of time. In this section, we will explore the volatility of gold investment and real estate investment, highlighting the key differences between the two.

Volatility of Gold Investment

Gold is often considered a relatively stable long-term investment. However, it is not completely immune to short-term fluctuations in value. Factors such as inflation, supply and demand dynamics, and geopolitical events can impact the price of gold. For example, periods of high inflation or economic uncertainty can drive up the demand for gold as a safe-haven asset, leading to increased prices. Conversely, a decrease in overall demand or increased supply can cause the price of gold to decline.

Volatility of Real Estate Investment

In comparison to gold, real estate tends to be more volatile. The value of real estate investments is influenced by various factors such as interest rates, housing inventory, and market trends. For instance, a rise in interest rates can increase borrowing costs, making it more difficult for potential buyers to afford homes. This can lead to a decrease in demand and a subsequent decline in property values. On the other hand, a low-interest-rate environment and high demand for housing can drive up property prices.

“Real estate is subject to market cycles and can experience significant fluctuations in value based on economic conditions and local factors.”

It is important to note that while real estate can be more volatile than gold, it also offers the potential for higher returns. Property values can appreciate over time, and rental income can provide a steady stream of cash flow. Additionally, real estate investments can be leveraged through mortgages, allowing investors to amplify their returns.

| Asset | Volatility |

|---|---|

| Gold Investment | Relatively Stable |

| Real Estate Investment | More Volatile |

Considering the volatility of an investment is crucial when determining which asset aligns with your risk tolerance and investment goals. While gold offers stability, real estate provides the potential for higher returns. It is recommended to hold gold investments for the long term to mitigate the impact of short-term volatility. On the other hand, real estate investments require careful consideration of market conditions and local factors that may influence property values.

Maintenance Costs

Investing in real estate comes with ongoing maintenance and upkeep costs that are necessary for the upkeep and preservation of the property. These costs typically range from 1% to 4% of the property’s purchase price per year. They include expenses such as repairs, renovations, and property management fees for rental properties.

On the other hand, gold investments do not require any maintenance as long as the gold is kept in a controlled environment. Gold is an inert metal that does not corrode or degrade over time, ensuring its long-term preservation. However, it is important to note that storing gold may incur storage fees if it is kept in a private vault or depository.

When considering the maintenance costs of real estate investment, it is important to factor them into the overall return on investment. These costs can impact the profitability of rental properties and the net income generated from real estate investments. Therefore, it is crucial to budget appropriately and account for these expenses to ensure the financial viability of the investment.

Maintenance Costs Comparison

To provide a clearer understanding of the maintenance costs associated with real estate investment and the storage fees of gold investment, the following table highlights the key differences:

| Investment Type | Maintenance Costs | Storage Fees |

|---|---|---|

| Real Estate | 1% to 4% of purchase price per year | N/A |

| Gold | N/A | May incur storage fees if stored in a private vault or depository |

Note: The above costs are approximate and may vary based on factors such as property location, size, condition, and storage facility.

Considering the maintenance costs and storage fees associated with each investment can help investors make informed decisions based on their budget, financial goals, and risk tolerance. It is important to weigh these costs against the potential returns and benefits of each investment option.

Historical Performance Between the Two Investments

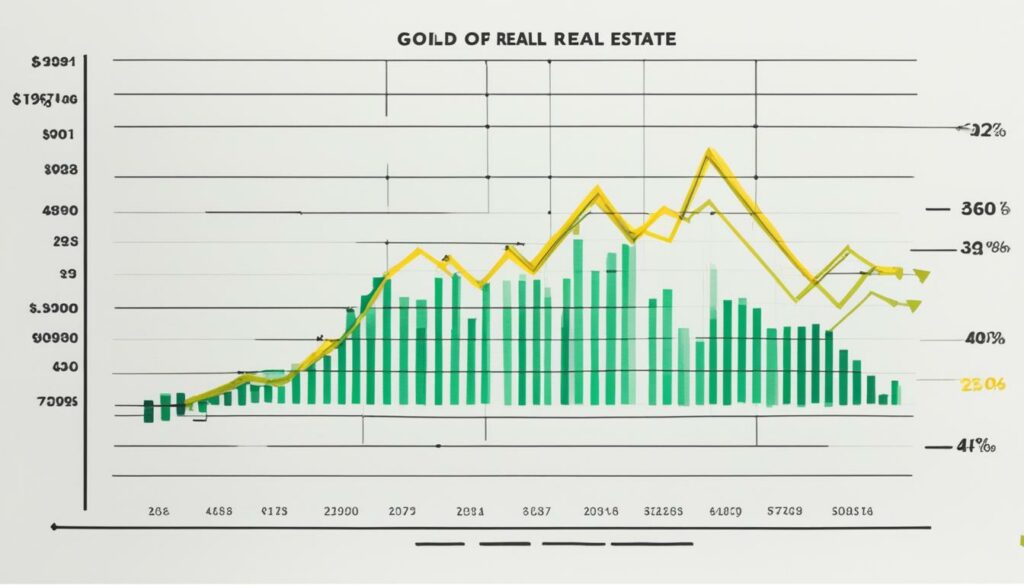

The historical performance of gold and real estate provides valuable insights into their potential returns as investment options.

Gold has consistently shown steady long-term growth, making it an attractive investment for many. On average, gold has delivered annual returns ranging from 3.96% to 9.09% depending on the analyzed time period.

Real estate, on the other hand, has experienced varying returns over the same time periods. The average annual returns for real estate investment range from 4.70% to 7.73%.

It’s important to note that past performance does not guarantee future results. Before making any investment decisions, investors should carefully consider their own financial goals, risk tolerance, and time horizon.

| Time Period | Average Annual Return of Gold | Average Annual Return of Real Estate |

|---|---|---|

| 2000-2010 | 5.82% | 6.25% |

| 2010-2020 | 7.39% | 7.73% |

| 2000-2020 | 4.26% | 4.70% |

How Are Gold and Real Estate Used as an Inflation Hedge?

Both gold and real estate are commonly used as potential inflation hedges, offering investors protection against the eroding effects of rising prices. These assets have historically shown the ability to maintain value or appreciate during inflationary periods. Let’s explore how gold and real estate serve as inflation hedges and safeguard against the impact of inflation.

Gold as an Inflation Hedge

Gold has long been regarded as a reliable store of value during inflation. When inflation rates rise, the purchasing power of fiat currency tends to diminish, leading investors to seek alternative assets like gold. The demand for gold typically increases during periods of high inflation, as investors view it as a hedge against currency devaluation.

Historically, gold has demonstrated an inverse relationship with inflation. As the value of currencies declines, the price of gold tends to rise, safeguarding investors’ purchasing power. This makes gold an attractive option for those looking to maintain the real value of their wealth in the face of inflationary pressures.

Key Takeaway: Gold’s inverse relationship with inflation and its perceived store of value make it a popular choice as an inflation hedge.

Real Estate as an Inflation Hedge

Real estate is another asset class that can provide protection against inflation. As inflation rates increase, real estate values tend to rise as well. This is because the cost of construction materials, labor, and land tend to increase during inflationary periods, leading to higher property valuations.

In addition to potential capital appreciation, real estate investments, particularly rental properties, can generate income that keeps pace with rising costs. Rental income can be adjusted to reflect inflationary pressures through rent adjustments, allowing investors to maintain cash flow relative to increasing prices.

Key Takeaway: Real estate investments can serve as an inflation hedge by providing both capital appreciation and rental income that keeps pace with rising costs.

The Benefits of Diversification

“Diversification is key when building a robust investment portfolio. By including both gold and real estate, investors can hedge against inflation while also benefiting from potential capital appreciation and income generation.”

By diversifying their investment portfolios and including both gold and real estate, investors can mitigate the risk associated with inflation. Each asset class offers unique advantages and may perform differently under varying economic conditions. As such, a well-rounded portfolio that combines different inflation-hedging assets can provide more stability and protect against unexpected changes in the economy.

| Asset Class | Characteristics | Inflation Hedge Benefits |

|---|---|---|

| Gold | Liquid, easily tradable | Inverse relationship with inflation |

| Real Estate | Tangible asset, income generation | Property value appreciation, rental income adjusted for inflation |

Key Takeaway: Diversifying an investment portfolio with both gold and real estate allows investors to harness the inflation-hedging benefits of each asset class, potentially enhancing returns and mitigating risk.

Overall, both gold and real estate have proven themselves as valuable tools for hedging against inflation. While gold provides liquidity and a historical inverse relationship with inflation, real estate offers appreciation potential and the ability to generate rental income that adjusts with rising costs. The decision to invest in gold, real estate, or both should be based on individual investment goals, risk tolerance, and market conditions. By carefully considering the role of each asset, investors can build a well-rounded portfolio that protects their wealth from the impacts of inflation.

Comparing Market Demand and Supply

When examining the investment potential of gold and real estate, understanding the market demand and supply dynamics is essential. Both assets, gold and real estate, have limited supply and undergo processes like mining and construction that take time. However, the market demand for each asset differs due to various factors.

Market Demand for Gold

Gold’s market demand fluctuates based on inflation rates and financial uncertainty. During times of economic instability and inflation, the demand for gold typically increases. Investors turn to gold as a safe-haven investment and a hedge against inflation to protect their wealth.

Furthermore, gold has a long-standing reputation as an enduring store of value and a symbol of wealth across cultures. This enduring appeal contributes to sustained market demand for gold, making it a valuable asset for investors seeking stability in their portfolios.

Market Demand for Real Estate

The market demand for real estate is influenced by factors such as housing prices and rental demand. Housing prices are often driven by supply and demand imbalances, economic conditions, and local factors such as population growth and employment opportunities.

Rental demand, on the other hand, is influenced by factors like demographics, urbanization, and lifestyle choices. In areas with a high demand for rental properties, real estate investments can provide a steady income stream and potential capital appreciation.

Understanding the market demand for gold and real estate is crucial for investors looking to make informed investment decisions. By staying informed about economic trends and assessing the factors driving market demand, investors can take advantage of investment opportunities in both gold and real estate.

Which Investment Has Better Returns: Gold or Real Estate?

When considering investments, one of the key factors to evaluate is the potential for returns. Gold and real estate are both popular investment options, but which one offers better returns?

Real estate investments have the potential for higher returns due to property value appreciation and rental income. Over time, properties often increase in value, allowing investors to sell them at a profit. Additionally, rental income from real estate properties can provide a steady cash flow, enhancing the overall return on investment.

On the other hand, gold investments offer a stable and long-term investment opportunity. Gold has historically preserved its value and served as a hedge against inflation. While its returns may be relatively low compared to real estate, gold provides stability and diversification to a portfolio.

To make a well-informed decision, investors need to consider their individual investment goals and risk tolerance. If the primary objective is income generation and potential high returns, real estate investments may be more suitable. On the other hand, if stability and diversification are the focus, gold investments can be a valuable addition to a portfolio.

“The key is to diversify your investment portfolio,” advises financial expert Jane Williams. “By combining both real estate and gold investments, you can maximize your chances of achieving higher returns while minimizing risk.”

It is important to note that the returns of both gold and real estate investments can vary based on market conditions and individual actions. Conducting thorough research, seeking professional advice, and staying informed about market trends are crucial steps for optimizing investment returns.

Remember: Investing always carries some level of risk, and past performance is not guaranteed to predict future results. Each investment option comes with its own advantages and considerations. Therefore, it is crucial to carefully evaluate your financial goals, risk tolerance, and investment timeline when deciding between gold and real estate.

Ultimately, the decision of which investment has better returns depends on individual circumstances and investment objectives. Consulting with a financial advisor or professional can help you make an informed decision that aligns with your specific goals and risk appetite.

What Are the Tax Implications of Investing in Gold and Real Estate?

Understanding the tax implications of your investment choices is crucial for effective financial planning. When it comes to investing in gold and real estate, the tax considerations can vary depending on the investment method and your individual circumstances.

Let’s start with gold investment. Profits from the sale of physical gold are generally subject to regular income tax rates. This means that any gains you make from selling gold will be added to your taxable income and taxed accordingly. However, it’s important to note that tax rates can vary based on your income bracket and the duration for which you held the gold.

Gold-backed exchange-traded funds (ETFs) and gold mining stocks, on the other hand, may face capital gains tax instead. Capital gains tax is levied on the profit made from selling an investment asset. If you sell your gold ETFs or gold mining stocks at a higher price than what you paid for them, the profit will be subject to capital gains tax.

Now let’s turn our attention to real estate investment. Real estate investments come with their own set of tax implications. First, there are property taxes, which are imposed by local governments and can vary depending on the location and value of the property. These taxes are typically calculated as a percentage of the property’s assessed value and are used to fund local services and infrastructure.

In addition to property taxes, real estate investments may also be subject to net investment income tax (NIIT) and real estate income tax. The NIIT applies to individuals with high investment income, including rental income from real estate properties. Real estate income tax, on the other hand, is levied on the income generated from real estate investments, such as rental income or profits from property sales.

Lastly, real estate investments can also trigger capital gains tax if you sell a property for a profit. Just like with gold investment, the amount of capital gains tax you’ll owe will depend on various factors, including the duration of ownership and your taxable income bracket.

To navigate the complex landscape of tax implications, it’s essential to consult with a qualified tax professional or financial advisor who can provide personalized guidance tailored to your specific situation. They can help you optimize your investment strategy by taking advantage of available tax benefits and minimizing tax liabilities.

| Tax Implications | Gold Investment | Real Estate Investment |

|---|---|---|

| Income Tax | Gains from physical gold sales subject to regular income tax rates | Real estate income from rentals subject to income tax |

| Capital Gains Tax | Gold-backed ETFs and gold mining stocks may face capital gains tax | Profit from selling a property may be subject to capital gains tax |

| Property Taxes | N/A | Property taxes imposed by local governments |

| Net Investment Income Tax (NIIT) | N/A | Applies to individuals with high investment income |

It’s important to note that tax laws and regulations are subject to change, and the information provided here is intended for informational purposes only. Always consult with a tax professional or financial advisor before making any investment decisions.

Conclusion

After considering factors such as liquidity, diversification, historical performance, inflation hedging, market demand and supply, expected returns, and tax implications, it is clear that both gold investment and real estate investment offer unique advantages and disadvantages. The decision between the two ultimately depends on individual investment goals, risk tolerance, and preferences.

Those seeking a highly liquid and easily accessible investment may find gold to be a suitable choice. Its tangibility and the ability to buy and sell gold through various channels make it attractive to new investors. On the other hand, real estate provides diversification and risk management opportunities, with the potential for higher returns through property appreciation and rental income.

To make an informed investment decision, it is recommended to consult with a financial advisor who can provide further guidance based on individual circumstances. They can help evaluate the advantages and disadvantages of each asset class and align them with investment goals. Ultimately, the choice between gold and real estate investment should be based on careful consideration and a thorough understanding of one’s financial objectives.