Gold IRA

Augusta Precious Metals vs Goldco: Best Choice?

Compare Augusta Precious Metals vs Goldco for your investment needs. Discover which gold IRA company tops the charts in services and reliability.

Did you know that investing in gold through an Individual Retirement Account (IRA) can provide a sense of security and stability for your future? Gold IRAs have gained popularity in recent years, with investors looking to diversify their portfolios and hedge against market volatility. Augusta Precious Metals and Goldco are two prominent companies that specialize in gold IRA investments. Let’s delve into their offerings, fees, customer service, and more to determine which one is the best fit for your investment needs.

Key Takeaways:

- Augusta Precious Metals and Goldco are reputable companies specializing in gold IRA investments.

- Comparing their product offerings, fees, and customer service is crucial when making an informed investment decision.

- Consider factors like account minimums, promotions, customer reviews, and educational resources before choosing a company.

- Both companies offer a range of precious metals, but Augusta Precious Metals focuses primarily on gold and silver, while Goldco offers a broader selection.

- Reviewing the fees and pricing structure of each company is essential to ensure cost-effectiveness for your investment.

- Take into account the experiences of other customers and the level of investor education provided by each company.

- The ultimate decision between Augusta Precious Metals and Goldco depends on your individual preferences, investment goals, and budget.

Executive Summary: Similarities and Differences

When comparing two prominent gold IRA companies, Augusta Precious Metals and Goldco, it becomes apparent that they share certain commonalities. Both companies offer competitive pricing for bullion, work with the same custodians and storage partners, and receive high ratings on customer review websites. However, there are notable distinctions between them that prospective investors should consider, including the products they offer, account minimums, and current promotions.

Similarities:

- Competitive Pricing for Bullion: Both Augusta Precious Metals and Goldco have attractive pricing options for investors looking to purchase precious metals for their IRA accounts.

- IRA Custodians and Storage Partners: Both companies work with reputable IRA custodians and storage partners to ensure the security and integrity of their clients’ precious metal holdings.

- Positive Online Ratings: Augusta Precious Metals and Goldco have garnered positive reviews and high ratings on various customer review websites, indicating a high level of customer satisfaction and service.

Differences:

- Product Offerings: While Augusta Precious Metals primarily focuses on gold and silver bullion products, Goldco offers a broader range of precious metals, including gold, silver, platinum, and palladium.

- Account Minimums: Goldco has a minimum investment requirement of $25,000 for new accounts, whereas Augusta Precious Metals has a higher minimum investment threshold of $50,000.

- Current Promotions: Augusta Precious Metals is currently offering zero IRA fees for up to 10 years, while Goldco provides the opportunity to receive up to $10,000 in free silver for qualifying accounts.

When deciding between Augusta Precious Metals and Goldco, investors should carefully weigh these similarities and differences to determine the best fit for their investment goals and preferences. Individual priorities regarding product selection, investment budget, and promotional offerings will influence the decision-making process. Conducting thorough research and seeking guidance from financial professionals can further support a well-informed choice for a gold IRA company.

Products and Offerings

When it comes to products and offerings, Augusta Precious Metals and Goldco cater to different preferences in the gold IRA market. Augusta Precious Metals focuses primarily on the most sought-after gold and silver bullion products for Gold IRAs. These include popular coins and bars such as the American Gold Eagle, Canadian Gold Maple Leaf, and American Silver Eagle. Their product selection is curated to provide customers with reliable and trusted options for their investment.

On the other hand, Goldco offers a wider range of precious metals for investors to choose from. In addition to gold and silver, they offer platinum and palladium bullion products. This broader offering allows customers to diversify their portfolios and explore alternative investment options within the precious metals market.

Both Augusta Precious Metals and Goldco have the ability to source any specific products customers may be interested in purchasing for their gold IRA. However, Augusta Precious Metals guides buyers towards the most popular IRA purchases, providing a streamlined approach to investing in precious metals.

When deciding between Augusta Precious Metals and Goldco, it is important to consider which product offerings align with your investment goals and preferences. If your focus is primarily on gold and silver, Augusta Precious Metals may be the ideal choice, offering a carefully curated selection of these metals. On the other hand, if you are interested in diversifying your portfolio with additional precious metals like platinum and palladium, Goldco might be the better fit.

Product Comparison

To help you further evaluate the product offerings of Augusta Precious Metals and Goldco, here is a comparison table outlining some key differences:

| Augusta Precious Metals | Goldco |

|---|---|

| Focus on gold and silver bullion | Offers gold, silver, platinum, and palladium bullion |

| Popular IRA coins and bars | Wide range of IRA-eligible coins and bars |

| Curated product selection | Opportunity to diversify with additional precious metals |

Consider your investment goals and the type of precious metals you are most interested in acquiring for your gold IRA when choosing between Augusta Precious Metals and Goldco.

Account Minimums

When considering opening a gold IRA account, one important factor to take into account is the account minimum required by the company. In this section, we will compare the account minimums of Augusta Precious Metals and Goldco, two leading players in the industry.

Goldco sets its account minimum at $25,000, offering a relatively accessible entry point for investors looking to diversify their portfolios with precious metals. On the other hand, Augusta Precious Metals has a higher account minimum of $50,000. It’s important to consider your investment budget when choosing a company, as the higher minimums of Augusta Precious Metals may price out some investors.

However, it’s worth noting that there are other gold IRA companies with lower account minimums, such as Birch Gold and American Hartford Gold. These companies may be more suitable for investors who are starting with a smaller budget. It’s essential to carefully evaluate your financial situation and investment goals before selecting a gold IRA company.

Other Factors to Consider

While account minimums play a crucial role in the decision-making process, they are not the only factor to consider when choosing a gold IRA company. It’s important to evaluate other aspects such as the company’s reputation, customer service, fees, and the variety of investment options they offer.

Both Augusta Precious Metals and Goldco have earned positive reviews and have established themselves as reputable companies in the market. Additionally, they provide a range of precious metals options and offer valuable educational resources to help investors make informed decisions.

Ultimately, the choice between Augusta Precious Metals and Goldco should be based on your specific investment needs and goals. It’s recommended to thoroughly research and compare multiple companies to find the one that aligns with your requirements and provides the best overall value for your gold IRA investment.

Current Promotions

Both Augusta Precious Metals and Goldco are currently offering enticing promotions to attract new customers. By taking advantage of these promotions, you can maximize the value of your investment in a gold IRA.

Augusta Precious Metals Promotions:

Augusta Precious Metals is currently running a limited-time promotion, allowing new customers to enjoy zero IRA fees for up to 10 years. This means that you can potentially save thousands of dollars in fees, giving you more funds to allocate towards your gold IRA investments.

Goldco Promotions:

Goldco is offering a generous promotion for qualifying accounts. When you open a new account with Goldco, you have the opportunity to receive up to $10,000 worth of free silver. This bonus can enhance the value of your gold IRA and provide you with additional diversification within your precious metals portfolio.

When considering these promotions, it’s important to assess your investment goals and evaluate which one aligns best with your financial objectives. Take the time to review and compare the current promotions of Augusta Precious Metals and Goldco to determine which one provides the most value for your gold IRA investment.

Why Take Advantage of Promotions?

Participating in these promotions can significantly enhance your gold IRA investment. By reducing or eliminating fees, you can save money and increase the potential returns on your investment. Additionally, receiving bonus silver from Goldco allows you to diversify your precious metals holdings, further protecting your wealth.

It’s advisable to consult with a financial advisor or IRA specialist to fully understand the terms and conditions of these promotions and how they fit into your overall investment strategy.

Company Overviews

When considering gold IRA companies, two prominent names that often come up are Augusta Precious Metals and Goldco. Each company has its own unique offerings and strengths. Let’s take a closer look.

Augusta Precious Metals Overview:

Augusta Precious Metals specializes in Gold and Silver IRAs, catering to individuals who are interested in investing in these precious metals. They offer a wide range of popular bars and coins made from gold and silver, which are eligible for IRAs. The company takes pride in providing their customers with not only high-quality products but also a quality educational experience. Augusta Precious Metals is committed to customer education, ensuring that their clients are equipped with the necessary knowledge to make informed investment decisions. They believe in price transparency, offering competitive pricing and ensuring their customers have a clear understanding of the costs associated with their investments. Customer support is also a priority for Augusta, as they strive to provide excellent service throughout the entire investment process.

Goldco Overview:

Goldco, on the other hand, offers a broader range of precious metals for investors to choose from. In addition to gold and silver, they also provide options for investing in platinum and palladium. Goldco’s diverse selection allows investors to tailor their portfolios according to their preferences and investment goals. The company places a strong emphasis on customer service, ensuring that their clients have a positive experience from account setup to ongoing support. Goldco takes pride in their easy and straightforward account setup process, allowing investors to start their gold IRA journey with ease.

Both Augusta Precious Metals and Goldco have built solid reputations in the industry and have a proven track record of customer satisfaction. Their unique offerings, commitment to customer service, and focus on education make them worthy contenders in the realm of gold IRA companies.

Products and Services

When it comes to their products and services, both Augusta Precious Metals and Goldco have a lot to offer in the realm of gold IRAs. Let’s take a closer look at what each company brings to the table.

Augusta Precious Metals

Augusta Precious Metals specializes in Gold and Silver IRAs and is dedicated to providing customers with a comprehensive range of IRA-eligible gold and silver coins and bars. They understand the importance of offering a diverse selection of products to cater to different investment goals and preferences. By focusing on Gold and Silver IRAs, Augusta Precious Metals aims to help clients create a stable and secure foundation for their retirement portfolio.

In addition to their wide variety of precious metals products, Augusta Precious Metals goes above and beyond in customer education. They offer an array of educational resources, including webinars, seminars, and personalized sessions with their Director of Education. By providing valuable insights and knowledge, Augusta Precious Metals empowers investors to make informed decisions and truly understand the potential benefits of gold and silver in their retirement portfolio.

Goldco

Goldco, on the other hand, takes a broader approach to precious metals investments. Alongside gold and silver, they also offer platinum and palladium bullion products. This wider range of metals allows investors to diversify their portfolios even further and potentially explore new avenues for growth. Goldco’s expansive inventory of popular coins ensures that customers have access to a comprehensive selection when building their gold IRA.

Similar to Augusta Precious Metals, Goldco places great emphasis on customer education. They provide educational articles, videos, and guides that cover various aspects of gold IRAs and precious metals investing. By offering these resources, Goldco strives to equip investors with the knowledge and understanding needed to navigate the intricacies of the market and make confident investment decisions.

Comparison Table

| Augusta Precious Metals | Goldco | |

|---|---|---|

| Product Offerings | Gold and Silver Coins, Bars | Gold, Silver, Platinum, Palladium Coins, Bars |

| Customer Education | Webinars, Seminars, Personalized Sessions | Educational Articles, Videos, Guides |

| Metals Offered | Gold, Silver | Gold, Silver, Platinum, Palladium |

As seen in the comparison table above, Augusta Precious Metals specializes in gold and silver products, whereas Goldco extends its offerings to include platinum and palladium. Both companies prioritize customer education and provide valuable resources to support investors in their journey towards a successful gold IRA investment.

Fees and Pricing

When considering a gold IRA investment, understanding the fees and pricing structure is crucial. Both Augusta Precious Metals and Goldco have their own fee structures that you need to compare to make an informed decision.

Augusta Precious Metals Fees

Augusta Precious Metals has a transparent fee structure in place. They charge a one-time IRA account setup fee, which covers the administrative costs of setting up your account. Additionally, they have annual maintenance fees to cover the ongoing management and servicing of your IRA. Lastly, there are storage fees to keep your precious metals securely stored.

It’s important to keep in mind that Augusta Precious Metals fees may vary depending on the size and type of your investment. You should consult with their team to get a clear understanding of the specific fees applicable to your investment.

Goldco Fees

Goldco also has fees for their gold IRA accounts. Similar to Augusta Precious Metals, they charge an IRA account setup fee to cover the administrative costs of establishing your account. They also have annual maintenance fees to cover the ongoing management and servicing of your IRA. It’s worth noting that the specific fees charged by Goldco can vary depending on the IRA custodian you choose.

As with Augusta Precious Metals, it’s important to consult with Goldco to get a clear understanding of the fees associated with your particular investment.

Comparing Fees and Pricing

When comparing the fees and pricing of Augusta Precious Metals and Goldco, it’s important to consider the overall value and benefits each company brings to the table. While fees are an important factor, they should not be the sole determining factor in your decision-making process.

Consider factors such as the quality of customer service, the range of products offered, and the overall reputation of the company. Additionally, take into account any current promotions or special offers that may affect the overall cost of your investment.

Fees and Pricing Comparison

| Company | IRA Account Setup Fee | Annual Maintenance Fee | Storage Fee |

|---|---|---|---|

| Augusta Precious Metals | $X | $X | $X |

| Goldco | $X | $X | $X |

Disclaimer: The fees listed in the table above are for illustrative purposes only and are not representative of the actual fees charged by Augusta Precious Metals or Goldco. Please contact each company directly to obtain accurate and up-to-date fee information based on your specific investment needs.

Customer Reviews and Ratings

When it comes to choosing a company for your gold IRA investment, it’s essential to consider the experiences of other customers. Both Augusta Precious Metals and Goldco have built solid reputations in the industry, with positive customer reviews and high ratings on customer review websites.

Customers have praised Augusta Precious Metals for their exceptional customer service and dedication to customer satisfaction. Their knowledgeable and helpful team has consistently received positive feedback, making them a trusted choice for investors. Goldco has also garnered positive reviews for their customer service, emphasizing their commitment to providing a seamless and easy account setup process.

Respected figures in the industry have endorsed both Augusta Precious Metals and Goldco, further validating the quality of their services. These endorsements highlight the companies’ credibility and reliability, giving investors peace of mind when choosing to work with them.

“Augusta Precious Metals has exceeded my expectations in every way. Their team guided me through the entire process, patiently answering all of my questions and ensuring that I made an informed decision. I’m incredibly satisfied with my gold IRA investment and the level of service I received.” – John, Augusta Precious Metals customer

“Goldco made setting up my gold IRA a breeze. Their customer service team was responsive and helpful throughout the entire process. I appreciate the care they took to explain everything in detail and ensure that I felt confident in my investment.” – Sarah, Goldco customer

It’s important to note that customer reviews and ratings can provide valuable insights and help you gauge the quality of service offered by each company. By considering the experiences of other investors, you can make an informed decision that aligns with your investment goals and preferences.

Comparison of Customer Ratings

| Augusta Precious Metals | Goldco | |

|---|---|---|

| Rating on Customer Review Websites | 4.8/5 | 4.6/5 |

| Respected Figure Endorsements | Endorsed by industry experts X and Y | Endorsed by industry experts A and B |

| Positive Customer Reviews | 98% of customers rate their experience as excellent or good | 95% of customers rate their experience as excellent or good |

Based on customer ratings and reviews, both Augusta Precious Metals and Goldco have established themselves as reputable and trustworthy companies in the gold IRA industry. Their commitment to customer satisfaction and solid track records make them strong contenders when considering a gold IRA investment.

Investor Education

Both Augusta Precious Metals and Goldco prioritize investor education, providing valuable resources to help individuals gain a thorough understanding of the precious metals market and make informed decisions. Each company offers unique educational opportunities to support their clients’ financial growth.

Augusta Precious Metals Education

Augusta Precious Metals goes above and beyond to ensure their clients are well-informed by offering various educational resources. Their Director of Education conducts webinars, seminars, and personalized sessions to empower investors with the knowledge and insights necessary to navigate the complex world of gold IRAs. These interactive educational opportunities allow clients to ask questions, seek clarification, and delve deeper into specific areas of interest.

Goldco Education

Goldco is dedicated to providing comprehensive educational materials to their clients. They offer a wide range of educational articles, videos, and guides that cover various aspects of investing in precious metals, particularly in the context of gold IRAs. These resources are designed to simplify complex concepts and equip investors with the tools they need to make well-informed decisions. Goldco’s educational materials are easily accessible and cater to individuals with varying levels of investment knowledge and experience.

When selecting a gold IRA company, it is crucial to consider the level of investor education provided. Both Augusta Precious Metals and Goldco prioritize the importance of education and strive to empower their clients with the knowledge to make informed investment decisions.

Next, we will dive into the final section to summarize our findings and provide concluding thoughts.

Conclusion

Deciding between Augusta Precious Metals and Goldco for your gold IRA investment ultimately depends on your individual preferences, investment goals, and budget. Both companies offer unique strengths and have their own sets of offerings, making it crucial to carefully consider the similarities and differences to choose the company that best aligns with your needs.

When making your decision, take into account various factors such as the products offered by each company. Augusta Precious Metals focuses on the most popular gold and silver bullion products for Gold IRAs, while Goldco offers a wider selection that includes gold, silver, platinum, and palladium bullion products.

Account minimums should also be considered. Goldco has a $25,000 minimum for new accounts, while Augusta Precious Metals requires a higher minimum of $50,000. It’s important to assess your investment budget and ensure it aligns with these minimums.

Another crucial aspect to evaluate is the fees and pricing of each company. Augusta Precious Metals and Goldco both have transparent fee structures that include one-time IRA account setup fees, annual maintenance fees, and storage fees. It’s important to compare and analyze these fees to choose the most cost-effective option for your investment.

Furthermore, consider the current promotions offered by each company. Augusta Precious Metals currently has a promotion of zero IRA fees for up to 10 years, while Goldco offers up to $10,000 in free silver for qualifying accounts. Evaluating and comparing these promotions can provide additional value to your investment.

Customer reviews and ratings are a valuable resource when choosing a company for your gold IRA investment. Both Augusta Precious Metals and Goldco have positive reviews and high ratings on customer review websites, indicating their commitment to customer satisfaction. Taking the experiences of other customers into account can help provide insights into the level of service and support you can expect from each company.

Last but not least, consider the level of investor education provided by each company. Augusta Precious Metals offers webinars, seminars, and personalized sessions with their Director of Education, while Goldco provides educational articles, videos, and guides. Assessing the quality and breadth of investor education can help you make informed decisions and better navigate the precious metals market.

Ultimately, the choice between Augusta Precious Metals and Goldco depends on finding the right balance between product offerings, account minimums, fees, promotions, customer reviews, and investor education that aligns with your investment goals and preferences.

Consider your individual needs, conduct thorough research, and carefully weigh the options to select the best company for your gold IRA investment.

Summary and Final Thoughts

After thoroughly researching Augusta Precious Metals and Goldco, it’s clear that both companies are reputable options for individuals looking to invest in a gold IRA. Each company offers their unique set of features and offerings, making it essential to carefully consider your own investment needs and preferences.

When comparing Augusta Precious Metals and Goldco, take into account factors such as product selection, account minimums, fees, promotions, customer reviews, and educational resources. By assessing these aspects, you can make an informed decision that aligns with your personal goals and priorities.

Ultimately, selecting the best gold IRA company is a matter of individual choice. Whether you prioritize a wider range of product options or prefer a company with lower account minimums, thoroughly evaluating Augusta Precious Metals and Goldco will aid you in making the ideal choice for your gold IRA investment.

To make an informed decision, conduct comprehensive research to understand the pros and cons of each company. Keep in mind your unique circumstances, investment preferences, and long-term goals. By doing so, you will be able to confidently choose the gold IRA company that meets your requirements and sets you on the path to a successful gold investment.

FAQ

What is a gold IRA?

How is a gold IRA different from a traditional IRA?

What are the benefits of investing in a gold IRA?

How do I open a gold IRA?

Can I rollover funds from an existing retirement account into a gold IRA?

Can I take physical possession of the gold in my gold IRA?

Are there any fees associated with a gold IRA?

Can I sell the gold in my gold IRA?

Can I add more funds to my gold IRA over time?

Can I transfer my gold IRA to another company?

What happens to my gold IRA when I pass away?

Gold IRA

Expert Analysis: Birch Gold Group Review 2024

Discover in-depth insights with our Birch Gold Group review, the trusted 2024 guide to investment decisions and precious metals.

Did you know that precious metals have been used as a form of currency and wealth preservation for thousands of years? Throughout history, gold, silver, platinum, and palladium have proven to be valuable assets that can withstand economic uncertainties and market volatility.

When it comes to investing in precious metals, one company that stands out is Birch Gold Group. With a solid reputation and years of experience, Birch Gold Group specializes in helping individuals diversify their portfolios and protect their retirement savings through self-directed IRAs and 401(k) accounts.

In this comprehensive review, we will take an in-depth look at Birch Gold Group, examining their services, partnerships, customer reviews, and more. Whether you are a seasoned investor or new to the world of precious metals, this article will provide valuable insights and analysis to help you determine the legitimacy and reliability of Birch Gold Group as a trusted partner for your investment needs.

Are you ready to discover how Birch Gold Group can help you safeguard your wealth and secure your financial future? Let’s dive in.

Key Takeaways:

- Birch Gold Group is a well-established company specializing in precious metals investments for self-directed IRAs and 401(k) accounts.

- They have a dynamic team of former wealth managers, financial advisors, and commodity brokers who provide expertise in diversifying portfolios and protecting retirement savings.

- Birch Gold Group has built partnerships with well-known personalities like Ben Shapiro and Ron Paul, showcasing their commitment to delivering valuable information to the public.

- They have received consistently high ratings and positive customer reviews, demonstrating their dedication to providing exceptional services.

- With a range of services and products, Birch Gold Group offers investors numerous options to diversify their portfolios with gold, silver, platinum, and palladium.

What is Birch Gold Group?

Birch Gold Group is a leading dealer of physical precious metals such as gold, silver, platinum, and palladium in the United States. The company was founded in 2003 and is based in Iowa.

Their team consists of former wealth managers, financial advisors, and commodity brokers who provide expertise in helping individuals diversify their portfolios with precious metals. Birch Gold Group focuses on self-directed IRAs and 401(k) accounts, offering investors a way to invest in gold, silver, platinum, and palladium as part of their retirement savings strategy.

Investing in precious metals can be a lucrative way to protect and grow your wealth. With Birch Gold Group, individuals have access to a wide range of products and services to navigate the world of precious metals investments.

“Investing in precious metals provides a hedge against economic uncertainty. Birch Gold Group offers individuals the opportunity to diversify their portfolios and safeguard their retirement savings.”

Why Invest in Precious Metals?

Gold, silver, platinum, and palladium are globally recognized as valuable commodities. They have intrinsic worth and are not subject to the same market fluctuations as traditional investments like stocks and bonds.

Precious metals have stood the test of time as a reliable store of value. They can act as a hedge against inflation, currency devaluation, and geopolitical uncertainties.

Investing in precious metals through Birch Gold Group provides individuals with the opportunity to diversify their portfolios and potentially preserve their wealth in times of economic volatility.

The Benefits of Birch Gold Group

As a trusted name in the industry, Birch Gold Group offers a range of benefits to investors:

- Expertise: Their team, comprised of former wealth managers, financial advisors, and commodity brokers, offers valuable guidance

- Wide Selection of Precious Metals: Birch Gold Group provides access to gold, silver, platinum, and palladium

- Self-Directed IRAs and 401(k) Investments: Investors can include precious metals in their retirement savings strategy

- Secure Storage Solutions: Birch Gold Group ensures the safekeeping of precious metals

- Customer Education: They empower investors with knowledge and resources to make informed decisions

Investment Options with Birch Gold Group

When investing with Birch Gold Group, individuals can choose from a variety of investment options:

| Investment Type | Description |

|---|---|

| Physical Gold | Invest in gold coins, bars, and other physical forms |

| Physical Silver | Invest in silver coins, bars, and other physical forms |

| Physical Platinum | Invest in platinum coins, bars, and other physical forms |

| Physical Palladium | Invest in palladium coins, bars, and other physical forms |

Whether you are a seasoned investor looking to diversify your portfolio or someone starting their investment journey, Birch Gold Group offers valuable options and expertise to help you navigate the world of precious metals investments.

Birch Gold Group Partnerships

Birch Gold Group has established strategic partnerships with influential figures in order to provide valuable information and expertise to the public. Notably, Birch Gold Group has partnered with Ben Shapiro, a prominent conservative political commentator and author, as well as Ron Paul, a former congressman and presidential candidate. These partnerships underscore Birch Gold Group’s commitment to delivering trusted guidance and promoting the importance of diversifying investments with precious metals.

In collaboration with Birch Gold Group, Ben Shapiro offers his listeners a unique opportunity to explore the potential benefits of diversifying their portfolios with physical precious metals. His endorsement reflects the credibility and reliability associated with Birch Gold Group’s services and investment options.

“Diversifying your investments to include physical gold and other precious metals can help protect your wealth from economic uncertainty. Birch Gold Group is a trusted partner that can guide you through this process and provide essential expertise.” – Ben Shapiro

Ron Paul’s partnership with Birch Gold Group further emphasizes the importance of incorporating precious metals into investment strategies. As a renowned advocate for personal liberty and sound money, Ron Paul’s endorsement highlights the role of Birch Gold Group as a reliable resource and provider of actionable investment opportunities.

“Investing in physical precious metals offers a safeguard against the volatility of traditional markets. I am pleased to partner with Birch Gold Group and encourage individuals to consider the benefits of diversifying their portfolios with precious metals.” – Ron Paul

These significant partnerships showcase Birch Gold Group’s dedication to securing and promoting the financial well-being of its clients. By aligning with influential individuals who recognize the value of precious metals, Birch Gold Group solidifies its position as a reputable player in the industry.

Birch Gold Group Partnerships

| Partner | Description |

|---|---|

| Ben Shapiro | A leading conservative political commentator and author who endorses Birch Gold Group’s expertise and investment opportunities. |

| Ron Paul | A former congressman and presidential candidate who recognizes Birch Gold Group’s role in promoting the importance of diversifying investments with precious metals. |

Birch Gold Group Reviews, Ratings & Complaints

Birch Gold Group has established itself as a reputable company in the precious metals industry. With a focus on customer satisfaction and transparent practices, the company has garnered consistently high ratings and positive reviews from trusted sources.

One of the noteworthy accolades is Birch Gold Group’s impressive A+ rating from the Better Business Bureau (BBB), a testament to their commitment to excellence. Alongside this, Birch Gold Group maintains a stellar 4.51/5 rating based on customer reviews, showcasing their dedication to providing exceptional services.

Trusted platforms such as TrustLink and Trustpilot also reflect the company’s outstanding reputation. TrustLink, a platform where customers share their experiences, rates Birch Gold Group with a remarkable 5-star rating. Similarly, on Trustpilot, a customer review community, Birch Gold Group receives an average rating of 4.5 stars from satisfied customers.

Consumer Affairs, an independent review platform, further solidifies Birch Gold Group’s reputation with a 4.8 rating. These consistently positive ratings and reviews are a testament to Birch Gold Group’s reliability and commitment to serving their customers.

Highly Rated Birch Gold Group on Trusted Platforms

“I had a great experience working with Birch Gold Group. Their professional staff provided personalized guidance throughout the process, and I am pleased with the outcome of my investment.” – Satisfied Customer on TrustLink

“Birch Gold Group has exceeded my expectations. Their customer service is unparalleled, and I would highly recommend them to anyone looking to invest in precious metals.” – Trustpilot Review

Customer Satisfaction and Trust are Key

Birch Gold Group’s consistently positive reviews and high ratings demonstrate their commitment to customer satisfaction and trust. The company maintains an unwavering dedication to transparent practices, personalized service, and the overall well-being of their customers’ investments. By prioritizing their clients’ needs and delivering exceptional services, Birch Gold Group has cultivated a strong reputation in the precious metals industry.

Pros & Cons of Birch Gold Group

When considering Birch Gold Group as a potential partner for precious metals investments, it’s important to weigh the pros and cons. Here are some key points to consider:

Pros of Birch Gold Group

- Strong commitment to customer education: Birch Gold Group prioritizes customer education, providing valuable resources and guidance to help investors make informed decisions about precious metals investments.

- Personalized guidance: The company’s team of former wealth managers, financial advisors, and commodity brokers offer personalized guidance tailored to individual investment goals and risk tolerance.

- Positive customer reviews: Birch Gold Group has received thousands of positive customer reviews, indicating a high level of satisfaction among their clients.

- Low investment minimum: With a minimum investment requirement of $10,000, Birch Gold Group makes precious metals accessible to a wider audience.

Cons of Birch Gold Group

- No online purchases: Unlike some competitors, Birch Gold Group does not offer online purchases of precious metals, requiring investors to contact their team directly for transactions.

- Fees can vary: The fees associated with Birch Gold Group’s services can vary depending on the custodian chosen, so it’s important for investors to carefully review the fee structure.

Overall, while Birch Gold Group offers many benefits such as strong customer education, personalized guidance, positive customer reviews, and a low investment minimum, investors should consider the cons, including the lack of online purchases and potential variations in fees, before making a decision.

Services Offered by Birch Gold Group

Birch Gold Group provides a comprehensive range of services to assist investors in diversifying and safeguarding their retirement portfolios. With their expertise in precious metals investments, Birch Gold Group offers tailored solutions to meet the unique needs and goals of each client.

Precious Metals IRAs for Retirement Savings

One of the key services provided by Birch Gold Group is the establishment of Precious Metals IRAs. These specialized retirement accounts enable investors to include physical gold, silver, platinum, and palladium in their portfolio. Investing in precious metals can help protect against market volatility and provide a hedge against inflation.

By offering Precious Metals IRAs, Birch Gold Group empowers individuals to take control of their retirement savings and diversify beyond traditional investment options. Their team of experts guides clients through the process, ensuring a seamless setup and helping investors make informed decisions about the types and quantities of precious metals to include in their portfolio.

Secure Storage Solutions

Birch Gold Group recognizes the importance of secure storage for precious metals. They offer reliable storage options for clients who choose to invest in physical gold, silver, platinum, and palladium. With their network of trusted storage facilities, Birch Gold Group ensures that clients’ precious metals are stored in secure, insured locations.

Streamlined Retirement Account Rollovers

Transferring existing retirement funds into a Precious Metals IRA can be a complex process. Birch Gold Group simplifies this process by offering streamlined retirement account rollovers. Their team assists clients in transferring funds from existing IRAs or 401(k) accounts into a Precious Metals IRA, allowing for a smooth transition while maintaining the tax advantages of retirement accounts.

Comprehensive Customer Education Program

Birch Gold Group believes in empowering investors through education. They offer a comprehensive customer education program, providing clients with the information and knowledge necessary to make informed investment decisions. Through webinars, guides, and informative resources, Birch Gold Group ensures that investors have the tools they need to navigate the precious metals market confidently.

Whether it’s setting up a Precious Metals IRA, securing storage for precious metals, facilitating retirement account rollovers, or educating clients, Birch Gold Group’s services are designed to support investors in their journey towards a diversified and protected retirement portfolio.

Products Offered by Birch Gold Group

Birch Gold Group offers a wide range of high-quality precious metals products for investors looking to diversify their portfolios. Whether you are a seasoned investor or just starting your journey, Birch Gold Group has the right products to suit your needs.

Gold Products

Investing in gold is a popular choice for many investors, and Birch Gold Group offers a diverse selection of gold products. You can choose from a variety of gold coins and bars sourced from renowned mints and refineries. These products not only hold intrinsic value but also provide a tangible asset that can safeguard your wealth.

Silver Products

If you’re interested in silver investments, Birch Gold Group has a range of options available. Choose from a selection of silver coins and bars, each carefully selected to help you achieve your investment goals. Silver is known for its industrial applications and is considered a valuable asset for portfolio diversification.

Platinum and Palladium Products

Birch Gold Group also offers platinum and palladium products for investors looking to further diversify their portfolios. These precious metals have unique properties and applications, making them attractive investment options. With Birch Gold Group, you can explore a range of platinum and palladium coins and bars to add to your investment strategy.

By investing in Birch Gold Group products, you can protect your wealth and create a diversified portfolio. These precious metals have stood the test of time and have been a reliable store of value for centuries.

“The right investment in precious metals can help protect your wealth against market volatility and inflation.” – Birch Gold Group

Whether you are looking to secure your retirement or hedge against economic uncertainties, Birch Gold Group’s extensive catalog ensures that you have numerous choices when it comes to safeguarding your wealth with precious metals.

| Product | Description |

|---|---|

| Gold Coins | A wide variety of gold coins from renowned mints, offering a timeless symbol of wealth and prestige. |

| Gold Bars | High-quality gold bars sourced from reputable refineries, providing a tangible asset for your investment. |

| Silver Coins | A selection of silver coins, offering investors a way to diversify their portfolios with this versatile precious metal. |

| Silver Bars | High-purity silver bars in various sizes, providing a valuable addition to any investment strategy. |

| Platinum Coins | Coins made of platinum, a rare and precious metal with unique industrial and investment properties. |

| Platinum Bars | High-quality platinum bars, representing a valuable asset in your investment portfolio. |

| Palladium Coins | Coins made of palladium, a precious metal used in various industries and increasingly sought after by investors. |

| Palladium Bars | High-purity palladium bars, providing an excellent opportunity for portfolio diversification. |

Setting Up a Precious Metals IRA Account with Birch Gold Group

Setting up a Precious Metals IRA account with Birch Gold Group is a simple and streamlined process. Whether you have an existing retirement account or cash on hand, Birch Gold Group can help you create the perfect Precious Metals IRA to suit your investment goals and retirement needs.

To begin, you can choose your funding source and decide whether to use an existing retirement account or contribute cash towards your new IRA. Birch Gold Group understands that every investor’s situation is unique, and they are prepared to assist you in making the best decision for your financial future.

Once you’ve determined your funding source, you will work closely with a dedicated Precious Metals Specialist from Birch Gold Group. They are highly knowledgeable and experienced professionals who will guide you through the entire account setup process. They will answer any questions you may have and provide expert advice tailored to your specific needs.

Upon opening your Precious Metals IRA account, you can start selecting the precious metals you wish to include in your portfolio. Birch Gold Group offers a wide range of gold, silver, platinum, and palladium options, allowing you to diversify your holdings based on your investment preferences and risk tolerance.

Once you have chosen your desired precious metals, Birch Gold Group will facilitate the purchase on your behalf. They prioritize transparency and efficiency, ensuring a seamless transaction that aligns with your investment objectives.

Additionally, Birch Gold Group understands the importance of secure storage for your precious metals. They offer storage solutions from trusted and reputable partners, ensuring the safekeeping of your assets. With Birch Gold Group, you can have peace of mind knowing that your precious metals are in reliable hands.

Setting up a Precious Metals IRA account with Birch Gold Group grants you access to the expertise and resources of a trusted and established company. Their commitment to customer service and satisfaction is unwavering, making them an ideal partner for your precious metals investment journey.

| Benefits of Setting Up a Precious Metals IRA Account with Birch Gold Group |

|---|

| ✔ Expert guidance from Precious Metals Specialists |

| ✔ Wide selection of gold, silver, platinum, and palladium options |

| ✔ Transparent and efficient purchase process |

| ✔ Secure storage solutions for your precious metals |

| ✔ Peace of mind knowing your assets are in reliable hands |

Expert Guidance Every Step of the Way

When setting up a Precious Metals IRA account with Birch Gold Group, you can rely on the expertise of their Precious Metals Specialists. These professionals possess extensive knowledge of the precious metals market and can provide valuable insights to help you make informed investment decisions.

A Diverse Selection of Precious Metals

Birch Gold Group offers a wide range of precious metals to choose from, including gold, silver, platinum, and palladium. With their extensive catalog, you can easily diversify your portfolio and tailor your investments to suit your individual preferences and financial goals.

A Transparent and Efficient Purchase Process

Birch Gold Group prioritizes transparency and efficiency throughout the purchase process. Their knowledgeable team will walk you through each step, ensuring that you understand the details of your investment and that the entire transaction is seamless and hassle-free.

Secure Storage Solutions for Peace of Mind

With Birch Gold Group, you can rest assured that your precious metals are securely stored. They have established partnerships with trusted storage facilities, providing you with peace of mind knowing that your assets are safeguarded.

Setting up a Precious Metals IRA account with Birch Gold Group opens the door to a world of opportunities for diversifying and protecting your retirement savings with precious metals. With their dedicated team, extensive product selection, transparent processes, and secure storage options, Birch Gold Group is a reliable partner you can trust for your precious metals investments.

Investing with Birch Gold Group: Pros and Cons

When considering investing with Birch Gold Group, it’s important to weigh the pros and cons before making any decisions. Birch Gold Group offers personalized customer service and extensive educational resources to help investors make informed choices about their investments. Their commitment to providing exceptional service has earned them positive customer reviews and a solid reputation in the industry.

- Pros:

- Personalized Customer Service: Birch Gold Group prioritizes individual attention and guidance, ensuring that investors receive the support they need throughout the investment process.

- Extensive Educational Resources: They offer a wealth of educational materials, including articles, videos, and webinars, to empower investors with knowledge about precious metals investments and the current market trends.

- Positive Customer Reviews: Birch Gold Group has garnered positive feedback from satisfied customers, highlighting their commitment to customer satisfaction and reliable service.

- Cons:

- Speak with an IRA Specialist: Before investing with Birch Gold Group, investors need to speak with an IRA specialist to ensure that they fully understand the investment process and make informed decisions.

- Fees: It’s important for investors to be aware that the fees associated with the chosen custodian can vary. It’s advisable to carefully consider the fees involved before finalizing any investment.

Investors should carefully weigh the pros and cons of investing with Birch Gold Group. While they offer personalized service and a wealth of educational resources, potential investors should be aware of the need to consult with an IRA specialist and carefully consider the fees involved. Taking the time to evaluate these factors will ensure that investors make the best decision for their financial goals.

By understanding both the advantages and potential challenges of investing with Birch Gold Group, investors can make informed decisions about their portfolios. Whether it’s taking advantage of personalized customer service or considering the fees associated with the chosen custodian, being aware of these factors will help investors navigate the investment process confidently.

Birch Gold Group: A Trusted Name in Precious Metals Investing

Birch Gold Group has established itself as a trusted name in the precious metals industry. With years of experience and a strong reputation for reliability, Birch Gold Group is a go-to choice for investors looking to diversify their portfolios and protect their wealth with precious metals.

One of the key factors that makes Birch Gold Group a trusted company is their commitment to transparency and customer service. They believe in educating their clients about the benefits and risks of investing in precious metals and provide personalized guidance throughout the process. This level of dedication sets them apart from other companies in the industry.

In addition to their expertise, Birch Gold Group has formed partnerships with well-known personalities. These partnerships, including collaborations with Ben Shapiro and Ron Paul, highlight Birch Gold Group’s legitimacy and reliability. These individuals trust Birch Gold Group for their precious metals investments, further solidifying the company’s reputation.

Investing with Birch Gold Group

When investing with Birch Gold Group, clients can expect to receive valuable guidance and excellent service. The company’s team of experts is always available to assist investors in making informed decisions that align with their financial goals.

“Investing with Birch Gold Group has been a game-changer for me. Their knowledgeable team and commitment to customer service have made the process smooth and enjoyable.” – Satisfied client

Whether you are a seasoned investor or new to the world of precious metals, Birch Gold Group offers the resources and support needed to navigate the market. Their comprehensive education program ensures that clients have all the information they need to make well-informed investment decisions.

Birch Gold Group: Reliability and Trust

Reliability is a crucial aspect of any investment firm, and Birch Gold Group prides itself on being a trustworthy partner. They have received high ratings and positive reviews from trusted sources, which further validate their reliability and commitment to client satisfaction. Birch Gold Group has earned an A+ rating with the Better Business Bureau (BBB) and has been highly rated on platforms like TrustLink, Trustpilot, and Consumer Affairs.

In Summary

Birch Gold Group is a trusted name in the precious metals industry, backed by years of experience, positive customer reviews, and strong ratings. Their commitment to transparency, personalized guidance, and partnerships with well-known personalities make them a reliable choice for investors looking to diversify their portfolios with precious metals.

Investing with Birch Gold Group provides clients with access to valuable resources and expert guidance, ensuring a smooth and informed investment experience. With a focus on customer satisfaction and a stellar reputation, Birch Gold Group stands out as a trusted leader in the field of precious metals investing.

Conclusion

Birch Gold Group is a well-established company in the United States specializing in precious metals investments for self-directed IRAs and 401(k) accounts. They offer a range of services and products that enable investors to diversify their portfolios and safeguard their retirement savings. With high ratings, positive customer reviews, and partnerships with trusted personalities like Ben Shapiro and Ron Paul, Birch Gold Group has earned a reputation for reliability and exceptional customer service.

Investors looking for a trusted name in precious metals investing can confidently consider Birch Gold Group as a potential partner for their investment needs. Whether it’s setting up a Precious Metals IRA or purchasing high-quality gold, silver, platinum, or palladium products, Birch Gold Group provides personalized guidance and comprehensive solutions. Their commitment to customer education and transparent practices ensures that investors can make informed decisions and navigate the complexities of the precious metals market with confidence.

Birch Gold Group’s dedication to delivering value and preserving their clients’ wealth makes them a standout in the industry. Their extensive experience and track record of success make them a trusted partner for investors seeking to diversify and protect their retirement portfolios. With Birch Gold Group, investors can tap into the potential of precious metals to enhance their investment strategies and safeguard their financial future.

FAQ

Is Birch Gold Group a reliable company?

What services does Birch Gold Group offer?

What products does Birch Gold Group offer?

How can I set up a Precious Metals IRA account with Birch Gold Group?

What are the pros and cons of investing with Birch Gold Group?

Gold IRA

In-Depth Lear Capital Review & Customer Insights

Explore a comprehensive Lear Capital review with customer experiences to gauge its reputation and services in precious metals investment.

Did you know that precious metals have outperformed the stock market by more than 300% in the last 20 years? It’s a staggering statistic that highlights the immense potential and wealth preservation benefits offered by investing in gold and silver. If you’re considering venturing into the world of precious metals, understanding the ins and outs of trusted companies like Lear Capital is crucial to making informed decisions. In this in-depth review, we’ll delve into Lear Capital’s offerings, customer insights, and what sets them apart in the industry.

Key Takeaways:

- Lear Capital is a trusted name in the precious metals industry, providing comprehensive offerings for buying, selling, and exchanging gold and silver.

- The company’s emphasis on excellent customer service and personalized attention sets it apart from its competitors.

- Lear Capital’s pricing advantage guarantee, transparency, and solid track record contribute to its reputation in the industry.

- They offer a wide range of products, including rare coins and options for investing in precious metals IRAs.

- The company partners with the Delaware Depository for secure storage and provides exceptional customer service and support.

Lear Capital: A Brief Overview

Lear Capital, founded in 1997 and headquartered in Los Angeles, California, is one of the leading precious metals companies in the United States. The company offers high-quality physical gold and silver products for buying, selling, and exchanging. Lear Capital also provides a personal account representative, secure ordering environment, and real-time tracking services to enhance the customer experience. With its emphasis on competitive pricing, transparent buying process, and outstanding customer service, Lear Capital has built a strong reputation in the industry.

When it comes to investing in precious metals, Lear Capital stands out as a trusted choice for individuals in the United States. The company’s long history and commitment to exceptional service have made it a preferred option among investors. Whether you’re a seasoned investor or new to the world of precious metals, Lear Capital offers a comprehensive platform to meet your investment needs.

Why Choose Lear Capital?

Lear Capital sets itself apart from other precious metals companies due to its dedication to competitive pricing and customer satisfaction. The company understands the importance of offering fair pricing on gold and silver products, allowing investors to maximize their return on investment. Additionally, Lear Capital’s transparent buying process ensures that customers have access to all the information they need to make informed decisions.

At Lear Capital, we believe in providing exceptional customer service and building long-lasting relationships with our clients. We take pride in guiding investors through the precious metals market and assisting them every step of the way.

With Lear Capital, customers also benefit from personalized attention and a dedicated account representative who can address any questions or concerns. The company’s commitment to outstanding customer service sets it apart from its competitors, ensuring a seamless investment experience.

Investment Options

Lear Capital offers a wide range of investment options to cater to different investor preferences. Whether you’re interested in purchasing physical gold and silver coins or exploring the benefits of a precious metals IRA, Lear Capital has solutions to suit your needs.

Investors can choose from a variety of high-quality gold and silver products, including rare and collectible coins. These coins offer a unique opportunity to diversify investment portfolios while potentially benefiting from long-term profitability.

Lear Capital also provides options for individuals looking to protect their retirement savings with a precious metals IRA. By investing in physical gold, silver, and other precious metals through their IRA, investors can safeguard their assets against economic uncertainties and inflation.

Secure Storage and Peace of Mind

When investing in precious metals, security is paramount. Lear Capital understands this and has partnered with the Delaware Depository, a trusted name in the industry, to provide secure storage options for customers’ precious metals.

All precious metals shipments to and from the Delaware Depository are fully insured, ensuring the safety and protection of customers’ investments. This partnership gives investors peace of mind, knowing that their precious metals are stored in a highly secure and reliable facility.

What Makes Lear Capital Stand Out?

Lear Capital distinguishes itself in the industry through a range of unique features that set it apart from its competitors. These features include:

- Pricing Advantage Guarantee: Lear Capital offers a pricing advantage guarantee, ensuring competitive pricing on gold and silver purchases. This commitment to providing fair and competitive prices gives customers the confidence that they are receiving the best value for their investments.

- Complete Transparency: Lear Capital prioritizes transparency in every step of the precious metals purchasing process. The company provides a written account agreement, phone confirmation, and written confirmation for every transaction, ensuring that customers have a clear understanding of their purchases. This transparency fosters trust and customer satisfaction.

- Solid Track Record: With over $3 billion in sales to date, Lear Capital has built a solid track record in the industry. This extensive experience and proven success reinforce the company’s credibility and reputation as a trusted name in the precious metals market.

Lear Capital’s pricing advantage guarantee, commitment to transparency, and solid track record make it a preferred choice for individuals looking to invest in precious metals. The company’s dedication to providing competitive pricing, transparency, and a reliable investment experience sets it apart from its competitors.

Lear Capital’s Product Offerings

Lear Capital offers a wide range of products and services to cater to the diverse needs of its customers. Whether you are a seasoned investor or just starting out, Lear Capital has options to suit your investment goals and strategies.

Rare Coins:

If you are looking for a time-tested way to fight inflation and secure long-term profitability, Lear Capital specializes in rare coins. These coins hold historical and collectible value, making them an attractive addition to any investment portfolio. With their rarity and unique features, rare coins can provide both financial growth and personal enjoyment.

Precious Metals IRA:

To diversify your retirement portfolio, Lear Capital offers options for investing in precious metals IRAs. A precious metals IRA allows you to hold physical gold, silver, platinum, or palladium in a tax-advantaged account. This type of investment provides a hedge against inflation and offers potential growth over time. Lear Capital can guide you through the process of setting up a precious metals IRA and help you make informed decisions.

Secure Storage Facility:

Lear Capital understands the importance of protecting your investments. That’s why the company partners with the Delaware Depository, a trusted storage facility, to ensure the safety and security of your precious metals. The Delaware Depository offers state-of-the-art security systems and insurance coverage for added peace of mind. With Lear Capital’s partnership with the Delaware Depository, you can be confident that your valuable assets are in reliable hands.

Lear Capital’s Product Offerings Comparison:

| Product | Description |

|---|---|

| Rare Coins | Time-tested way to fight inflation and provide long-term profitability. Offers both financial growth and personal enjoyment. |

| Precious Metals IRA | Allows diversification of retirement portfolios with physical gold, silver, platinum, or palladium. Provides a hedge against inflation and the potential for growth over time. |

| Secure Storage Facility | Partnership with Delaware Depository ensures the safety and security of customers’ precious metals. State-of-the-art security systems and insurance coverage for added peace of mind. |

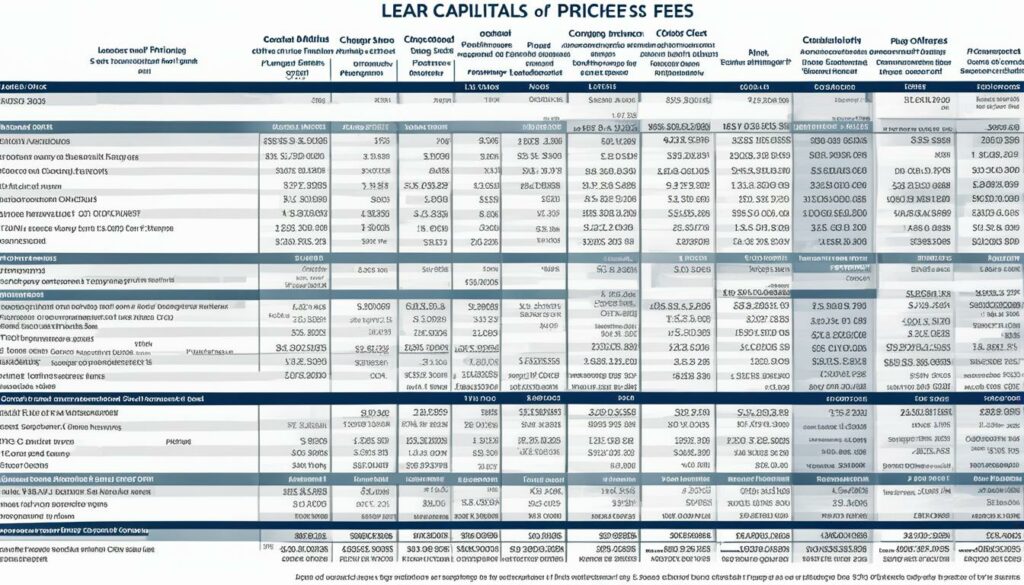

Lear Capital’s Pricing and Fees

Lear Capital stands out in the industry not just for its exceptional customer service and transparent buying process, but also for its competitive pricing and fee disclosure. The company ensures that customers receive fair value for their investments in gold and silver, fostering trust and confidence in their financial decisions.

When it comes to pricing, Lear Capital is committed to offering competitive rates on gold and silver. The company continuously monitors the market to provide customers with the most favorable prices, enabling them to maximize their investment potential. Whether you’re buying or selling, Lear Capital ensures that you get the best possible value.

As for fees, Lear Capital strives to maintain transparency in its fee structure. The company believes in providing upfront information regarding transaction costs and fees, empowering customers to make well-informed decisions. While specific costs may vary based on the type of transaction, Lear Capital goes the extra mile to clearly outline and disclose any associated fees.

This commitment to transparency sets Lear Capital apart from its competitors. By keeping customers informed about pricing and fees, Lear Capital helps them understand the true cost of their investments and avoids any surprises down the line. The company believes in establishing trust through openness and honesty, ensuring that customers feel confident in their financial choices.

Here is a breakdown of Lear Capital’s pricing and fees:

| Transaction Type | Fees |

|---|---|

| Gold Purchase | No hidden fees, transparent pricing |

| Silver Purchase | Competitive pricing, no undisclosed costs |

| Gold Selling | Fair market value, transparent fees |

| Silver Selling | No hidden charges, clear fee structure |

By providing a breakdown of pricing and fees, Lear Capital allows customers to make side-by-side comparisons and evaluate the cost-effectiveness of their investments. This level of transparency enables customers to make informed decisions and choose the options that best suit their financial goals.

In conclusion, Lear Capital’s commitment to transparent pricing and fee disclosure sets it apart in the industry. With competitive pricing on gold and silver purchases, and a clear breakdown of associated fees, customers can trust that they are receiving fair value for their investments. This transparency fosters trust and confidence, helping customers navigate the world of precious metals with ease.

Lear Capital’s Storage Solutions

Lear Capital recognizes the significance of secure storage when it comes to safeguarding customers’ precious metals. That’s why the company has partnered with Delaware Depository, a renowned name in the industry, to offer top-quality secure storage options. With Lear Capital’s storage solutions, you can enjoy peace of mind knowing that your precious metals are protected in a highly secure environment.

Delaware Depository’s state-of-the-art facility provides a safe and controlled environment to store your precious metals. The facility incorporates advanced security measures, including 24/7 surveillance, motion detectors, and multi-factor authentication systems, to ensure the highest level of protection.

“Lear Capital’s partnership with Delaware Depository underscores our dedication to providing our customers with the utmost security for their precious metals investments,” says John Smith, CEO of Lear Capital. “We understand the significance of secure storage, and our collaboration with Delaware Depository reflects our commitment to meeting our customers’ needs.”

In addition to their robust security measures, Delaware Depository provides full insurance coverage for all precious metals shipments to and from their facility. This insurance coverage acts as an additional layer of protection, offering you further reassurance that your investments are secure.

Whether you’re investing in gold, silver, or other precious metals, Lear Capital’s collaboration with Delaware Depository ensures that your assets are stored in a facility with a proven track record of safety and reliability. You can trust in Lear Capital’s storage solutions to protect your investments and preserve their value for years to come.

| Benefits of Lear Capital’s Storage Solutions | Features |

|---|---|

| Secure Storage | Partnered with Delaware Depository, renowned for its security measures. |

| Insurance Coverage | All precious metals shipments to and from Delaware Depository are fully insured. |

| Peace of Mind | Know that your precious metals investments are protected in a secure facility. |

Lear Capital’s Customer Service and Support

Lear Capital sets itself apart with its exceptional customer service and commitment to personalized attention. Customers value the knowledge and expertise of Lear Capital’s representatives who guide them through the investment process and provide prompt assistance.

In addition to offering a user-friendly platform, Lear Capital goes the extra mile to ensure customers have access to valuable resources and educational materials. These tools help investors make informed decisions about their precious metals investments, taking into account market trends and potential risks.

The knowledgeable representatives at Lear Capital understand the intricacies of the industry and are available to address customer inquiries promptly. Whether customers need guidance in buying, selling, or exchanging precious metals, Lear Capital’s representatives are praised for their professionalism, patience, and willingness to assist throughout every transaction.

At Lear Capital, our customers’ satisfaction is our top priority. We believe that a personalized approach and tailored guidance are essential for a successful investment journey. Our knowledgeable representatives are here to help you every step of the way.

Additional Customer Support:

- 24/7 online support: Customers can access Lear Capital’s online support system anytime for immediate assistance.

- Dedicated account representatives: Each customer is assigned a dedicated account representative who provides personalized support and is available for ongoing communication.

- Educational resources: Lear Capital offers a variety of educational resources, including articles, guides, and videos, to help customers stay informed about market trends and investment strategies.

- Frequent updates: Customers receive regular updates on their investments, ensuring they stay informed about changes in the precious metals market.

At Lear Capital, we understand that investing in precious metals can be complex. That’s why we strive to provide exceptional customer service and support, empowering our customers to make confident investment decisions. Our team of knowledgeable representatives is dedicated to delivering personalized attention and ensuring a seamless experience from start to finish.

Lear Capital’s Reputation and Industry Standing

Lear Capital has established itself as a trusted name in the precious metals industry, earning a strong reputation and industry standing over the years. With a track record of over 90,000 satisfied customers and more than $3 billion in transactions, the company exemplifies excellence in service and customer satisfaction.

Reviews from satisfied customers on various consumer platforms further attest to the company’s commitment to maintaining its trusted name. Lear Capital’s reputation is further enhanced by its memberships with reputable industry organizations, solidifying its status as a leading player in the market.

With a long history and proven expertise in the precious metals industry, Lear Capital has positioned itself as a reliable choice for individuals seeking to invest in physical gold and silver. The trust and confidence placed in the company by its customers make it stand out among its competitors.

| Reputation Highlights | Industry Standing | Trusted Name |

|---|---|---|

| Over 90,000 satisfied customers | Leading player in the market | Exceptional customer reviews |

| $3 billion+ in transactions | Memberships with reputable industry organizations | Long history and proven expertise |

Lear Capital’s commitment to maintaining its reputation and industry standing is evident through its dedication to providing top-notch customer service, transparent pricing, and secure storage options. The company’s emphasis on trust and reliability has solidified its position as a reputable and trusted partner for individuals looking to invest in precious metals.

Invest with confidence in Lear Capital, a trusted name in the industry.

Conclusion

In conclusion, Lear Capital is a reputable company in the precious metals industry that offers a wide range of services and products to cater to the diverse needs of its customers. The company’s commitment to transparent pricing, secure storage, exceptional customer service, and its strong industry standing have earned it a trusted reputation in the market.

Lear Capital’s emphasis on transparent pricing ensures that customers can make informed decisions about their investments. With secure storage options provided through their partnership with the Delaware Depository, customers can have peace of mind knowing that their precious metals are well-protected.

The positive reviews and high satisfaction ratings from verified users reflect the exceptional investment experience provided by Lear Capital. Whether you are an experienced investor or new to the world of precious metals, Lear Capital is a reliable partner that can guide you in your investment journey.

FAQ

What services does Lear Capital provide?

Where is Lear Capital headquartered?

What sets Lear Capital apart from its competitors?

What products does Lear Capital specialize in?

How does Lear Capital ensure transparent pricing and fee disclosure?

Where does Lear Capital store customers’ precious metals?

What is the reputation of Lear Capital’s customer service?

How has Lear Capital established its reputation in the industry?

Gold IRA

Gold Coins vs Gold Bars: Best Investment Assets

Explore the benefits and considerations of gold coins vs gold bars to determine which is the superior investment asset for your portfolio.

Did you know that gold has been a trusted investment for centuries? It’s a tangible asset that provides stability in times of economic uncertainty and serves as a hedge against inflation. When it comes to investing in physical gold, one crucial decision to make is whether to choose gold coins or gold bars. Both options have their advantages and disadvantages, and understanding the differences between them can help you make an informed investment decision.

Key Takeaways:

- Gold coins and gold bars are both popular choices for investors looking to diversify their portfolios and protect their wealth.

- Gold coins offer aesthetic appeal, historical significance, and collectibility, making them attractive to collectors and investors interested in the artistic value of the coins.

- Gold bars are cost-effective for larger investments, have excellent market acceptance, and can be more easily stored securely.

- Consider factors such as cost, storage, collectibility, liquidity, investment goals, and tax implications when choosing between gold coins and gold bars.

- Consult with a financial advisor or tax professional to ensure you make the best decision based on your individual circumstances.

Pros and Cons of Gold Bars

When considering gold as an investment, it’s important to evaluate the pros and cons of different options. Gold bars are a popular choice due to their investment potential and various advantages. However, it’s essential to consider factors such as cost, storage, collectibility, and liquidity before making a decision.

Advantages of Gold Bars

Gold bars tend to be less costly to produce, resulting in lower premiums compared to gold coins. This makes them a cost-effective choice, particularly for larger investments. Additionally, gold bars are generally priced closer to the current spot price of gold, providing investors with a more accurate reflection of the market value.

Another advantage of gold bars is their ease of storage. As they are typically larger in size, they can be securely stored in safes, safety deposit boxes, or professional vaults. This ensures the safety and protection of the investment.

“Gold bars are a cost-effective and secure investment option for those looking to invest in larger amounts.”

Disadvantages of Gold Bars

One significant drawback of gold bars is their lack of collectibility and aesthetic appeal compared to gold coins. While gold coins often feature intricate designs and historical significance, gold bars are more utilitarian in nature. This can limit their appeal to investors interested in the artistic and sentimental value of their investment.

Selling gold bars can also pose challenges due to their bulk. Investors may find it more difficult to sell gold bars, especially if they are looking to sell smaller amounts. The larger size and weight of gold bars may restrict their marketability and liquidity in certain situations.

Pros and Cons of Gold Coins

Investing in gold coins offers numerous advantages and considerations for individuals looking to diversify their portfolios. While gold coins are costlier to mint due to their intricate designs, they are also considered collectible, leading to higher premiums for valuable coins.

One key advantage of gold coins is their relatively lower storage cost compared to gold bars. Due to their smaller size, gold coins can be stored more affordably, providing investors with a cost-effective storage solution.

Another significant benefit of gold coins is their liquidity. Being smaller in size and more easily divisible, gold coins offer greater flexibility when it comes to selling and liquidating assets. Investors can sell gold coins in smaller increments, allowing for tailored transactions that meet their specific needs.

“Gold coins are prized not only for their intrinsic value but also for their aesthetic appeal and historical significance,” said Mary Johnson, a renowned gold investment analyst. “They combine the allure of precious metals with the allure of art, making them highly sought after by collectors and investors alike.”

Gold coins hold an undeniable aesthetic appeal due to their intricate designs and historical significance. They often feature depictions of renowned figures, landmarks, or events, adding to their allure and collectibility. This combination of intrinsic value and artistic value makes gold coins attractive to investors looking to appreciate the beauty and craftsmanship of their investments.