To balance growth and safety in your IRA using a barbell strategy, focus most of your investments on low-risk assets like short-term bonds, cash equivalents, and high-quality government or corporate bonds. Allocate a smaller portion to high-risk, high-reward assets such as stocks or sector ETFs for growth. This approach protects your capital during downturns while offering growth potential. Keep an eye on rebalancing and adjusting asset mix as your goals evolve—exploring these strategies further can help optimize your plan.

Key Takeaways

- Allocate 70-90% of your IRA to low-risk assets like short-term bonds and cash equivalents for stability.

- Invest 10-30% in high-growth assets such as stocks or sector ETFs to pursue higher returns.

- Rebalance regularly to maintain the desired barbell shape and risk profile as market conditions change.

- Use high-quality bonds to reduce default risk and diversify across maturities to manage interest rate sensitivity.

- Adjust your allocations based on your retirement timeline, risk tolerance, and economic outlook for optimal balance.

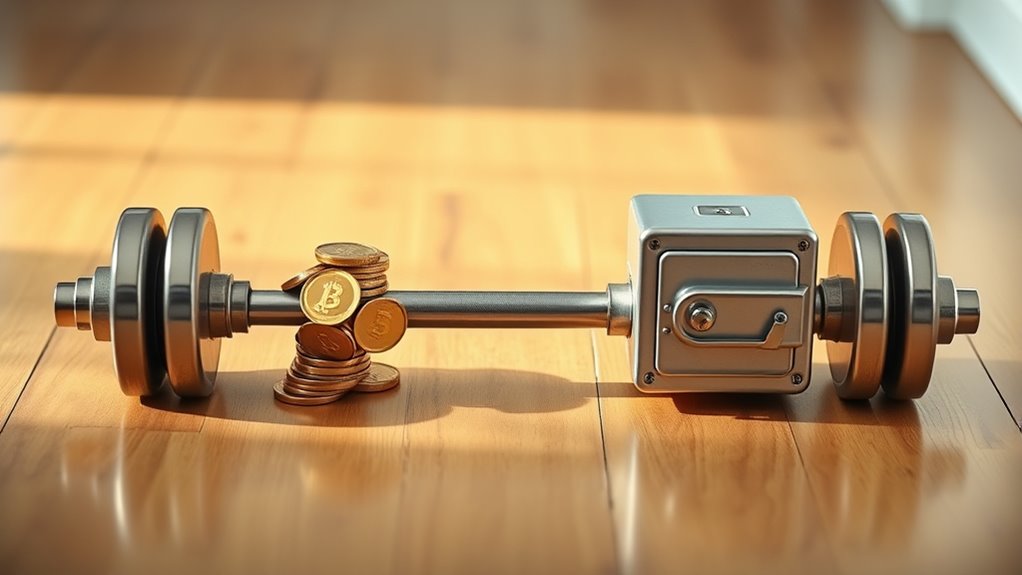

The IRA “Barbell” Strategy is an investment approach that balances risk by focusing on two opposite ends of the spectrum—very low-risk assets and high-risk, high-reward investments. Instead of spreading your money evenly across a broad range of assets, you concentrate most of your holdings in safe, stable investments while allocating a smaller portion to aggressive opportunities. This creates a portfolio shaped like a barbell, with the safety on one side and growth potential on the other. The idea is to protect your capital from steep declines while still having the chance to achieve high returns. The strategy was popularized by Nassim Nicholas Taleb, emphasizing antifragility—gaining from disorder and unexpected events—and benefiting from Black Swan events. In fixed income, this strategy involves combining short-term bonds and long-term bonds, skipping the intermediate maturities. Short-term bonds and cash equivalents, like Treasury bills, money market funds, or CDs, provide stability, liquidity, and flexibility. They’re less sensitive to interest rate fluctuations and help preserve your capital. On the other side, long-term bonds or high-growth assets, such as stocks or sector ETFs, are riskier but offer higher yields and potential for significant appreciation. You might allocate around 70% to 90% of your IRA to these low-risk investments, with the remaining 10% to 30% in more aggressive assets. This split allows you to enjoy downside protection because most of your assets are in safe investments, reducing the chances of large losses during market downturns. The smaller allocation to high-risk assets offers upside potential, enabling your portfolio to grow substantially if those investments perform well. It also provides liquidity, as short-term bonds and cash components can be easily sold or reinvested, allowing you to adapt to changing interest rates or market conditions. Additionally, balancing short- and long-term bonds helps mitigate interest rate risk since these assets respond differently to rate movements. Avoiding medium-risk investments means you steer clear of uncertain outcomes and hidden risks that come with those assets. Understanding market volatility and how different assets react to economic changes is crucial for maintaining this balance effectively. To implement this strategy in your IRA, you should actively rebalance your holdings, buying new short-term and long-term bonds as existing ones mature. Using high-quality government or corporate bonds reduces default risk, and adjusting the allocation based on your retirement timeline or risk appetite ensures your portfolio aligns with your goals. Keep in mind, long-term bonds can be vulnerable to rising interest rates, and high-risk assets like stocks or cryptocurrencies can suffer steep downturns or total losses. Inflation can also eat into your real returns, especially on fixed income holdings. Active management is essential to maintain the balance and prevent your portfolio from drifting toward either extreme, ensuring it continues to serve your safety and growth needs effectively.

Frequently Asked Questions

How Often Should I Rebalance My Ira’s “Barbell” Portfolio?

You should rebalance your IRA’s “barbell” portfolio at least once a year, or more often if market conditions change considerably. Regular rebalancing helps maintain your desired risk level and ensures your investments stay aligned with your goals. Keep an eye on performance and consider rebalancing after major market swings or when your personal circumstances shift. Staying proactive helps you manage risk while pursuing growth effectively.

What Are the Best Asset Types for the Safety Side?

You want the safest assets in your IRA, so think ultra-stable options like Treasury bonds, highly rated CDs, and money market funds. These investments are practically immune to market chaos, giving you peace of mind that your money is locked in tight. While they might not skyrocket, they’ll keep your principal safe and secure, acting as a financial fortress against any storm.

How Do Taxes Impact My “Barbell” IRA Strategy?

Taxes considerably impact your barbell IRA strategy by affecting your after-tax returns. Traditional IRAs offer tax-deferred growth, meaning you pay taxes upon withdrawal, which can be advantageous if you expect lower income in retirement. Roth IRAs, on the other hand, allow tax-free withdrawals, ideal if you anticipate higher future tax rates. You should optimize your asset allocation considering current and future tax implications to maximize growth and safety.

Can This Strategy Be Applied to Other Retirement Accounts?

Absolutely, you can adapt this “barbell” strategy across various retirement accounts like 401(k)s and Roth IRAs. By pairing prudent safety with bold growth, you diversify your dollar decisions and diminish risks. This dynamic dual approach works well, whether you’re managing traditional or Roth accounts. You leverage your layered investments, balancing stability and stretching potential, so your savings stay strong and secure regardless of account type.

What Are Common Mistakes to Avoid With a “Barbell” Approach?

You should avoid overconcentrating your investments in either high-risk or ultra-safe assets, which can skew your balance and increase vulnerability. Don’t ignore diversification within each “end” of your barbell, as it can limit your potential gains or safety. Also, steer clear of neglecting regular rebalancing; market shifts can throw off your strategy, so stay vigilant and adjust as needed to maintain your desired risk-reward balance.

Conclusion

Remember, a balanced approach is like walking a tightrope—you need both caution and confidence. By adopting a “barbell” strategy in your IRA, you’re fundamentally diversifying your investments to pursue growth while safeguarding your future. It’s about finding that sweet spot where risk and security meet. As the saying goes, “Don’t put all your eggs in one basket.” Keep that in mind, and you’ll stride toward financial stability with purpose and peace of mind.